While National Economic Performance Has Supported State Revenue Growth, Greater Spending Restraint Is Still Required

Wayne Winegarden and Nikhil Agarwal

November 2024

Three months into the 2024-25 fiscal year, state revenues are outperforming lowered expectations. Should these trends continue, the FY2025-26 budget process may avoid the crushing deficit problem that plagued the FY2024-25 budget negotiations, but only if our political leaders employ a disciplined approach toward spending. The need for spending control is amplified because economic risks persist, and California has still not sufficiently addressed the state’s long-term fiscal challenges.

Revenue Trends Are Currently Exceeding Expectations

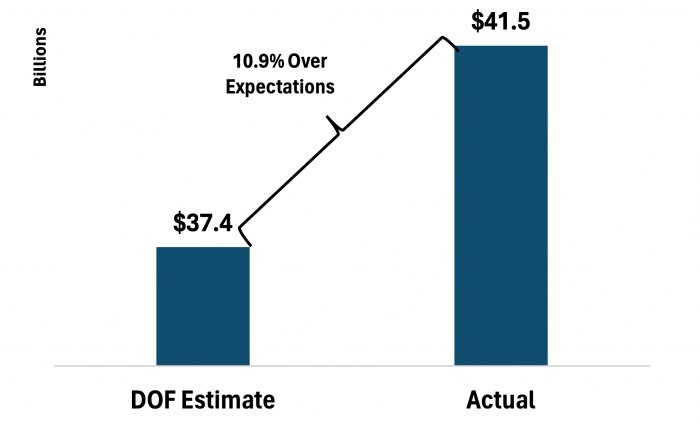

According to the California State Controller, total state revenues were $41.5 billion during the first quarter of FY2024-25, which were $4.1 billion higher than the estimated $37.4 billion. Growth in personal and corporate income tax revenues were responsible for the higher-than-expected revenue performance.

The fact that personal and corporate income tax revenues exceeded expectations is unsurprising. National economic growth has performed well – the growth in personal income adjusted for inflation has exceeded 3 percent thus far in 2024. Stocks and financial investments are also appreciating. Compared to one year ago (as of November 1, 2024), both the NASDAQ and S&P 500 are up more than 30 percent.

FY2024-25 Revenues Beating Expectations

Due to California’s steeply progressive income tax system, better-than-expected economic performance translates into even faster growth in tax revenues, which is why personal and corporate income tax revenues are surpassing expectations.

Budgetary Caution Is Still Warranted

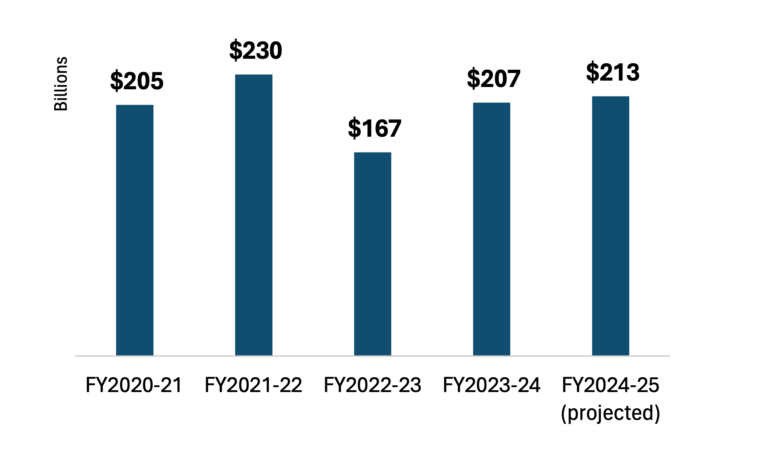

While revenues are performing well against expectations, based on the share of revenues that tend to be raised between July and September of each year, total revenues are still on pace to grow less than 1 percent annually between FY2020-21 and FY2024-25. This slow growth in revenues argues against spending any potential surplus from the current fiscal year on any new spending programs. Instead, the Governor and legislators should prioritize fiscal discipline by allocating any excess revenues to the state rainy day fund or addressing the state’s long-term unfunded pension liability problem, which is estimated to be $1.5 trillion or $38,713 per person when valued using a more appropriate risk-free interest rate. Paying down CalPERS debt is particularly valuable given Governor Newsom’s controversial Prop 2 accounting shift that supplanted, not supplemented “what the state would otherwise have to provide CalPERS in 2024-25.”

Total State Revenues Remain Stagnant From a 5-year Perspective

Economic Risks Still Hang Over California

Tight spending control is also warranted due to the risks associated with the current economic outlook. While the economy has performed respectably for much of 2024, there are reasons for concern. Take the recent employment report as an example. Growth in non-farm and private sector employment in the U.S. has been trending lower throughout the year and the employment markets stagnated in October 2024 based on the preliminary estimates.

More problematically, California’s employment market has been weaker than the national average since the end of the Covid recession. Total national employment has not yet regained its pre-recession employment growth trend – total nonfarm employment is still 2.9 percent lower than where they would have been based on the previous growth trend. However, things are worse in California where total nonfarm employment is 6.8 percent smaller than its pre-recession trend.

Then there are lingering financial problems. Consumer delinquency rates (particularly credit card delinquencies) are rising. Financial difficulties are also impacting the commercial real estate market. According to a 2024 Harvard Business Review analysis, “over the next two years, more than $1 trillion in commercial real estate (CRE) loans will come due”. Further “the damage could metastasize into a full-blown financial crisis if scores or even hundreds of small- and midsize commercial banks fail simultaneously. A worst-case scenario might include contagion to other economies and banking deserts across the U.S.”

These data indicate that the risks of a severe economic slowdown may be increasing. As we have documented in previous Spending Watch pieces, the revenue volatility from California’s progressive tax system runs both ways. Revenues may surge into Sacramento when the economy is growing and the financial markets are booming, but they also crash when economic growth slows. Should these growth risks assert themselves, then revenues for the rest of the fiscal year could still disappoint.

Impact of New Trump Administration

A disciplined approach to spending is also imperative because President-elect Trump may reduce the generosity of the federal funds that California receives. The Biden-Harris Administration gave California $6 billion for the high-speed rail, for instance, including money to connect San Francisco, Los Angeles, the Central Valley, and neighboring states to the east. It is not only possible that any unallocated funds from this support will be rescinded, but it is increasingly likely that no new support will be forthcoming. And the ill-considered high-speed rail project is only one of many areas where fewer federal resources will be available to the state. Expanding spending commitments in the face of these tighter federal resources will exacerbate future budget difficulties.

Conclusion

It is said that investors earn their money in bear markets and simply collect the returns during bull runs. State governments, on the other hand, determine the severity of the next budget slowdown during the good times and either reap the benefits, or pay the price, when the next economic slowdown comes. An optimistic reading of the first quarter revenue data illustrates that California may be entering such a crossroad.

State revenue performance through the first quarter of FY2024-25 exceeded expectations. Even if revenues continue to meet (or exceed) expectations, lessening the possibility that another fiscal crisis will arise during the FY2025-26 budget process requires state leaders to focus on controlling spending and addressing the state’s long-term fiscal challenges. A disciplined approach to spending will prove even more valuable should this optimistic revenue scenario prove elusive and current economic risks derail growth and cause state tax revenues to falter. Either way, California’s road to fiscal sustainability requires vigilant budget discipline.