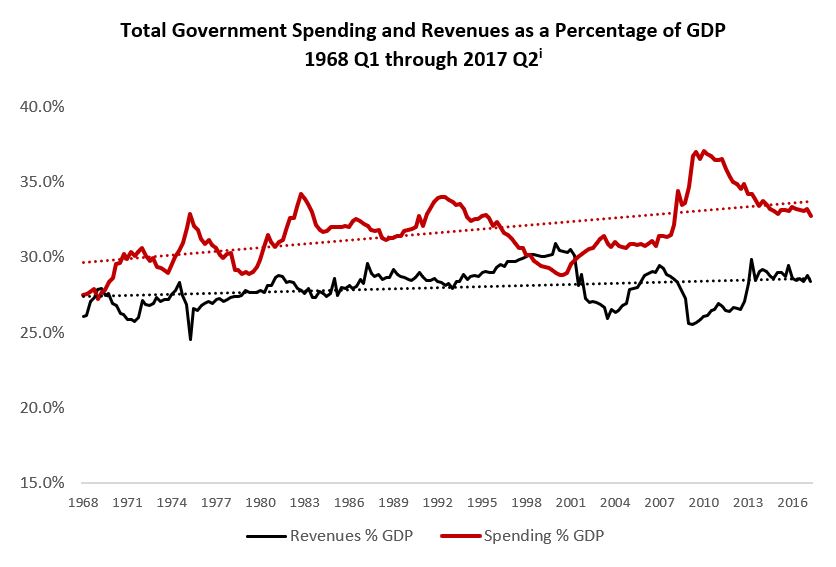

Washington D.C. has turned its sights on tax reform. Critics, almost reflexively, oppose the effort based on claims that tax reform will increase the deficit. A little perspective is in order, consequently. The chart below presents data on total federal, state, and local government revenues and spending relative to the size of the economy (or as a percentage of GDP).

Source: Bureau of Economic Analysis (www.bea.gov; Tables 1.1.5 and 3.1

The government budget deficits that have persisted for the past half century (except for the years just preceding the dot.com crash) are visualized by the gap between the red line and the black line in the figure. These persistent deficits are caused by the combination of frequent spending surges, followed by politicians’ unwillingness to realign spending with the actual revenues available. Importantly, total government revenues’ share of the economy has been relatively stable at 28.0 percent of GDP despite the significant increases and decreases in tax rates that have been implemented during this period.

Since it is the continuous growth in government spending that has caused the government deficits, it logically follows that spending control is required to eliminate the expected future deficits; regardless of whether tax reform is implemented or not.

The purpose of tax reform, on the other hand, is to reduce the unnecessary costs the current overly-complex tax system imposes on the economy. These costs reduce economic opportunity, lower income growth, and diminish job opportunities for all Americans.

The implications are clear. We need both tax reform, to remove the tax-induced constraints to growth, and spending control, to eliminate the deficit-induced constraints to growth.

Wayne Winegarden, Ph.D. is a Senior Fellow in Business and Economics at the Pacific Research Institute and Managing Editor for EconoSTATS.