The May Revision Should Assume A Weaker Fiscal Position for FY2025-26

Wayne Winegarden

April 2025

The recently enacted tariffs are significant tax increases on consumption and production, as I discussed in a February 2025 PRI Issue Brief. These tariffs will increase costs for consumers and reduce profits for businesses both large and small. The tariffs will also reduce the amount of foreign investment in the U.S. economy. With less investment, productivity growth will be lower, and interest rates will be higher, which will also be detrimental to economic growth in the short- and long term.

Worsening these economic impacts, a growing number of our trading partners are responding to the U.S. tariffs with retaliatory actions of their own. These policies, while harmful to their own residents, will further increase the costs on the U.S. Due to the policy created headwinds, and without a course correction, the possibility that the U.S. economy will experience an outright recession has become significantly more likely. And recent data indicate that these adverse outcomes are occurring.

For example, GDPNow estimates that the economy will contract 2.4 percent in the first quarter of 2025 (as of April 9, 2025). GDPNow is a running estimate of the growth in real GDP that the Federal Reserve Bank of Atlanta calculates. The steep volatility of the stock market (as of April 9, 2025) also reflects investors’ collective concerns regarding the health of the economy.

A potential economic slowdown, particularly a potentially weakening stock market, is pertinent to California’s upcoming FY2025-26 budget process. In his January Budget, Governor Newsom expected that the personal income tax revenues will raise $133.7 billion in the coming fiscal year. Given the current national economic trends, it is less likely that the state will meet this revenue target.

Key Takeaways

- Since the January Budget was released, national economic volatility and a budding global trade war will likely weaken state personal income tax revenue growth for the upcoming budget year. A $3.4 billion Medi-Cal budget gap worsens the state’s fiscal position further.

- Should the recent weak stock market persist, FY2025-26 income tax revenues could underperform by $7.0 billion to $12.3 billion compared to the Governor’s January Budget.

- Without stricter expenditure controls, the tax increases necessary to raise these lost revenues would shrink California’s economy by up to 3.7 percent, create 412,000 fewer jobs, and reduce median household incomes by nearly $1,740.

The typical relationship between the performance of the stock market and California’s personal income tax revenue growth provides a sense of how large the potential revenue miss may be. As is well understood in Sacramento, California has an exceptionally volatile income tax system that is closely linked to overall stock market performance. When the stock market performs well, and capital gains realizations surge, California’s income tax revenues grow robustly. When stock market performance lags, and capital gains realizations plummet, growth in California’s income tax revenues suffer.

Based on this historical relationship, if the S&P 500 was flat during FY2025-26, personal income tax revenues would be expected to grow around 4.6 percent compared to the 10.4 percent expected in the Governor’s January budget – a shortfall of $7.0 billion compared to expectations. If the stock market declined by 10 percent during the upcoming fiscal year, then personal income tax revenues will be essentially flat in FY2025-26 – they would grow by a mere 0.2 percent, which would cause a $12.3 billion shortfall compared to expectations. Importantly, these estimates do not account for any additional tax revenue losses, which will likely result from a large recession and would create additional revenue losses compared to Newsom’s January Budget.

Further worsening the state’s fiscal position, Medi-Cal is running a $3.4 billion budget shortfall. To cover this shortfall, Governor Newsom is borrowing against the general fund. This borrowing creates another unplanned drain on state resources, which is another indication that California’s fiscal health may be deteriorating quickly.

These risks demonstrate that the actual FY2025-26 budget should prioritize spending control to a much larger extent than the Governor’s January budget imposed. Ignoring the need for more fiscal restraint raises the possibility that tax increases will be necessary to balance the budget.

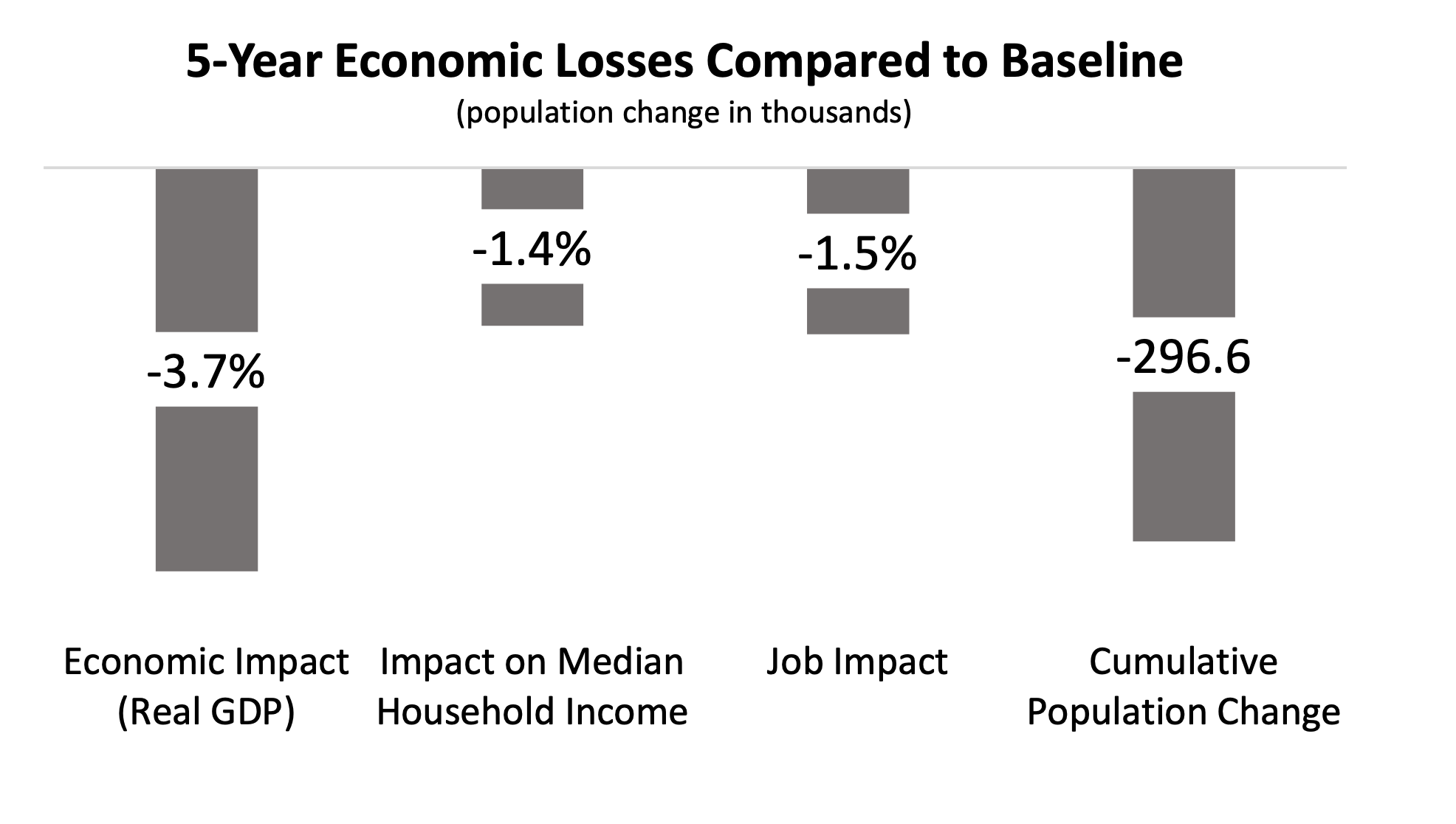

Using the 10 percent decline in the stock market as an example, raising the $12.3 billion in revenues that the Governor’s January Budget anticipated but were lost to the slowing economy would require significant increases in the personal income tax rates. Specifically, assuming the tax increases would be imposed on higher income earners, California would need to impose a two-percentage point increase in the tax rates for everyone in the 9.3 percent tax bracket and above (single filers earning above $70,607 and married couples filing jointly earning $141,213 and above). Such a large tax increase would create additional economic distress. Based on PRI’s Tax and Budget model, compared to the economic baseline, these increases would

- reduce California’s economic growth by up to 3.7 percent,

- create 412,000 fewer jobs,

- reduce median household income by nearly $1,740, and

- encourage an additional 296,600 people to leave the state.

Covering a smaller revenue shortfall through tax increases would necessitate smaller increases in tax rates. The resulting economic impacts, while still troubling, would be lessened.

Conclusion

The imposition of tariffs at the national level has put all states, including California, in a more difficult financial position. Unless there are drastic changes soon, California’s fiscal position is likely to be significantly more tenuous than the Governor’s January Budget assumed. Given these risks, the Governor should emphasize greater expenditure control in the May Revision. The alternative is to raise taxes during an anemic economy. Such a policy will further weaken economic growth to the detriment of Californians’ wellbeing.