Right by the Bay has sounded the alarm on the affordable housing crisis, especially our colleague Kerry Jackson, who has written about it here, here, and here. But until we get real reform, like Sam in Casablanca, we plan to play it again and again.

A new study by Apartment List analyzed median rents in 100 of the largest U.S. cities. They calculated the minimum gross income required to rent these apartments without surpassing the 30 percent threshold (the maximum percent of gross income the U.S. Department of Housing and Urban Development recommends we should spend on rent) and compared that income to the actual median household income for the same location.

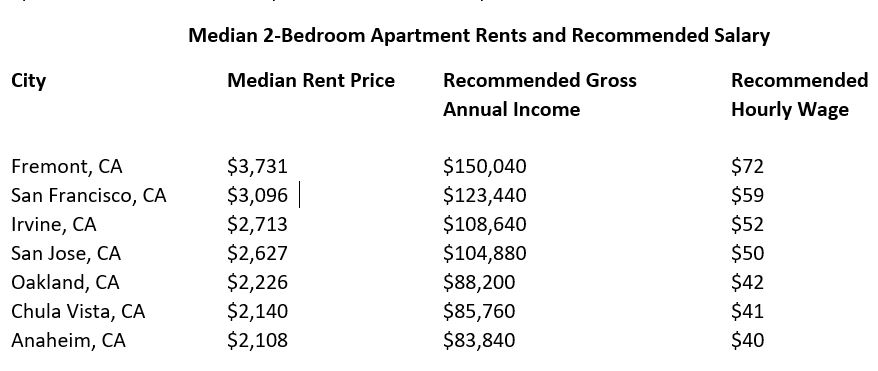

One of the key findings of the study, writes Sania Tran of Apartment List, is that, “cities within metropolitan areas with the lowest homeownership rate are being affected the most by affordability issues.” San Jose, Los Angeles, San Francisco, and San Diego have some of the lowest homeownership rates according to the most recent data. The study concludes that the trend might be the reason that these cities, along with surrounding suburbs such as Fremont, Irvine, and Chula Vista make up the top cities with the highest recommended salaries to rent a two-bedroom apartment (see table below).

As rent prices rise, workers are moving to more affordable nearby cities and commute or work remotely. Fremont, California, home to many of Silicon Valley’s techies and where Tesla has a major plant, is a clear example of this trend. Year-over-year growth of median-priced apartments in Fremont reached 3.6 percent, surpassing the national average of 0.9 percent. Moreover, Fremont leads the nation, according to the study, where you need to earn the most money to afford rent out of America’s 100 largest cities. It is the only city on the list that a worker must earn a 6-figure salary to rent a median-priced 1-bedroom apartment. It’s also on the top of the list for studio apartments and 2-bedrooms.

Apartment List’s conclusion? “As homeownership is becoming less and less attainable, many forego purchasing a home and opt to rent to avoid down payments and long-term mortgages,” writes Tran. “Our data shows that the increasing demand for rentals in cities with declining homeownership rates, paired with limited investment in new multifamily construction, cause an increase in rental prices around the nation.”

Apartment List’s conclusion? “As homeownership is becoming less and less attainable, many forego purchasing a home and opt to rent to avoid down payments and long-term mortgages,” writes Tran. “Our data shows that the increasing demand for rentals in cities with declining homeownership rates, paired with limited investment in new multifamily construction, cause an increase in rental prices around the nation.”

Gov. Newsom has called for a “Marshall Plan for affordable housing.” But instead of the courage and vision of the architects of the Marshall Plan, Newsom has opted for the Money Talks approach. In his budget, he proposes that if cities meet new benchmarks for housing production, they’ll be able to access a pool of $500 million in funds. If they fail, they lose out on money for road repairs from the California gas tax. He’s only made vague references for reforming the California Environmental Quality Act (CEQA), the state’s housing-business-job-killer act all rolled into one. Reforming CEQA would truly be on the level of the Marshall Plan and would earn Newsom, as PRI’s Kerry Jackson wrote, the title of the greatest governor in California history.

Rowena Itchon is senior vice president of the Pacific Research Institute.