After spending the holiday season consulting liberal academics, State Senate Democrats on Thursday unveiled their answer to President Donald Trump’s tax cut law.

Calling their proposal an effort to “protect California residents” from the federal tax cut proposal that was signed into law just before Christmas, Senate Bill 227 would “allow taxpayers to make charitable donations to the California Excellence Fund, and in return receive a dollar-for-dollar tax credit on the fully amount of their contribution.”

This is despite the findings of the nonpartisan Tax Policy Center that more than 90 percent of Americans will pay less in taxes thanks to the Trump tax cuts.

As with everything in government, the devil is in the details. Senate Democrats do not say how the money “contributed” to this new state slush fund would be spent. As I noted last week, it’s also unclear whether this new scheme would be legal under the state and federal constitutions, or whether it would undermine Prop. 13.

In an interview on CNN on Thursday, Senate de León let the cat out of the bag.

The real intention behind this bill is not protecting taxpayers, but fueling more Sacramento spending.

“When you have a massive tax cut, like the one that just occurred in Washington, you have to still pay the bills,” de León said, before rattling off a litany of spending priorities.

It’s ironic that this plan is being called the “Protect California Taxpayers Act” when Californians are paying high taxes thanks to actions of state lawmakers over the years.

Two proposals introduced last week would give overtaxed Californians some relief.

Assemblyman Vince Fong, R-Bakersfield, introduced what he’s calling a “California Competitiveness and Innovation Act,” which will provide middle-class and small-business tax relief.

In a video statement announcing his plan, Fong said, “this will start to make California more competitive with other states, and help ordinary Californians afford to live and work in California.”

Also, Assemblyman Matthew Harper, R-Huntington Beach, announced his own tax cut legislation. His proposal calls for the Legislature to “return the state’s expected ($7.5 billion) budget surplus to taxpayers . . . in the form of reduced income tax rates.”

“Rather than expanding an ever-growing list of government programs, our leaders should figure out a way to return that money to the people who earned it in the first place,” Harper said.

Whatever you think about the federal tax cut bill, last week’s legislative announcements on taxes shows it has brought about something long overdue – a healthy debate about California’s tax and spending priorities.

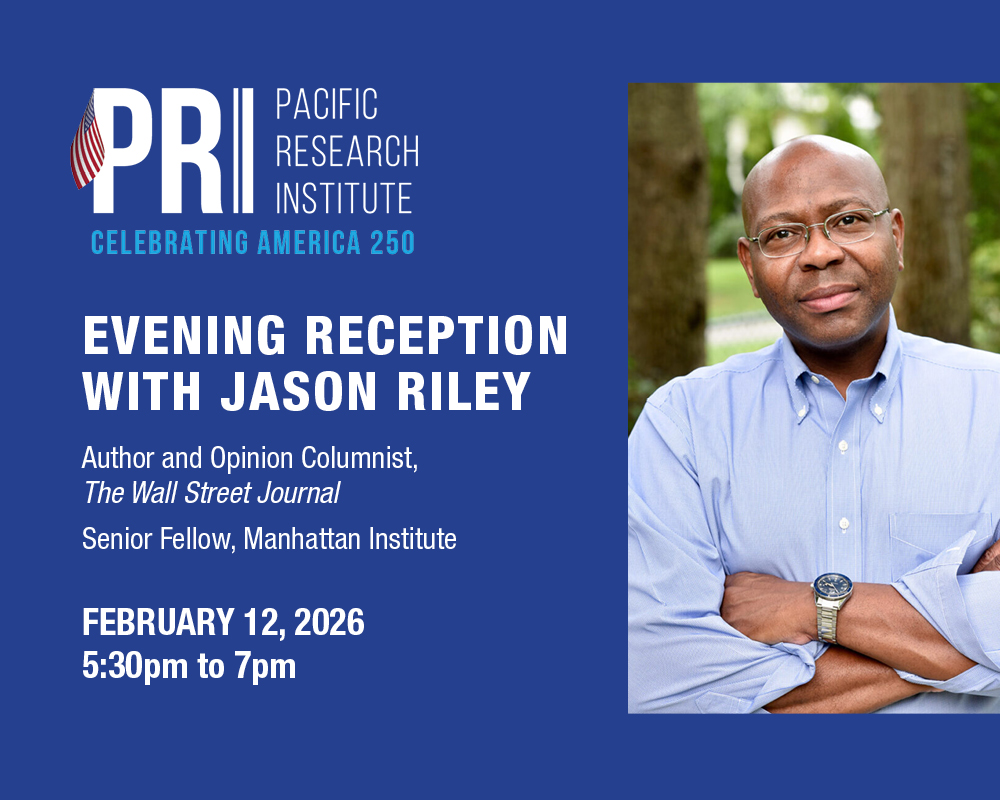

Tim Anaya is communications director for the Pacific Research Institute.