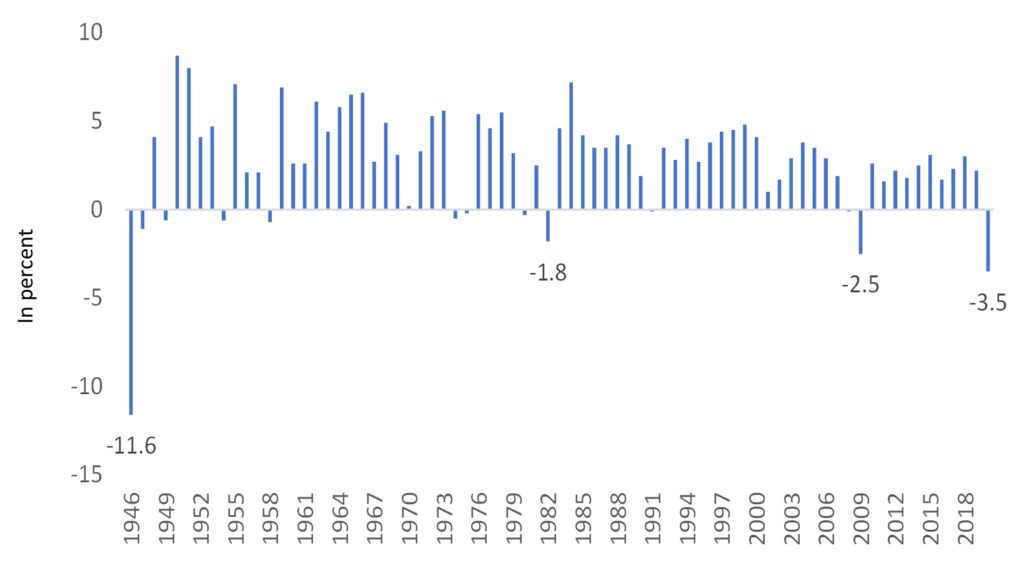

The argument for an economic stimulus seems persuasive. The economy contracted 3.5 percent in 2020, which is the largest annual decline in the national economy since 1946. The latest employment numbers, which were a disappointment to many, seem to further confirm the urgent need for Congress to immediately pass a large stimulus.

Annual Percent Change in Real Gross Domestic Product

1946 – 2020

Source: Bureau of Economic Analysis

Source: Bureau of Economic Analysis

While the data do not lie, interpretation matters. And, there are strong reasons to believe that the economy is not suffering from a Keynesian demand shortage. Instead, the economy will likely experience a strong rebound once the pandemic is behind us.

First, while the annual economic decline was devastating in 2020, all of the damage occurred in the second quarter (April through June 2020). Since June, the economy has been expanding, and expanded at a 4.0% annual growth rate in the fourth quarter of 2020. In normal times, this would be considered spectacular growth, and it should be viewed as a sign of underlying economic strength, particularly in light of the ongoing economic shutdowns.

Second, as for employment, yes, the employment report was disappointing, and job growth was revised downward in November and December. But, the economy still added 49,000 jobs in January, and more important, the three-month average illustrates positive job growth. Again, given the widespread economic shutdowns that have been imposed, this is also a hopeful sign. The 6.3 percent unemployment rate is also an encouraging sign because it demonstrates that the unemployment rate has declined to levels that are well below the typical recessionary peaks.

Third, the federal government has already spent, or allocated, over $3 trillion toward the crisis, which is the equivalent of 15 percent of the entire $21.5 trillion U.S. economy. In addition to these expenditures, the Federal Reserve expanded its purchases of government bonds and directly lent money to businesses, which added trillions of dollars to the economy. All of these programs were unprecedented, and have inflated real disposable personal income. Incomes are now higher today than before the pandemic, and, the savings rate is 13.7 percent. To put this increase in perspective, excluding the jump to an unprecedented 34 percent following the first stimulus checks, households in the U.S. now have the highest savings rate since 1975!

After-tax Personal Income in the U.S.

2000 – 2020

(monthly)

These trends demonstrate that once the economy fully opens up, pent-up demand will cause the economy to surge, particularly for the social activities like restaurants and entertainment venues that people have been denied for so long.

I have argued that most of these government expenditures were never needed to help the economy recover, and expenditures should have been tightly focused on supporting those businesses and individuals who were harmed by the pandemic. But, what’s done is done. However, the spending, GDP, employment, and income data indicate that the justifications for an additional $1.9 trillion economic stimulus are spurious, and President Biden’s claim that this spending is “urgent” is simply not true. Not only is a smaller spending package not “inadequate to the task at hand” any additional spending is unnecessary and risky.

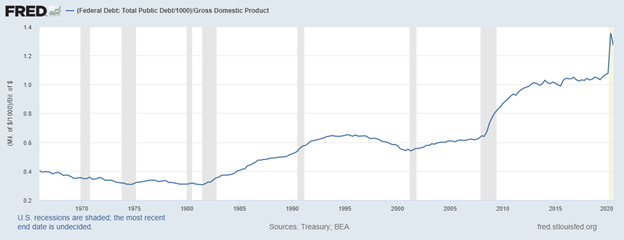

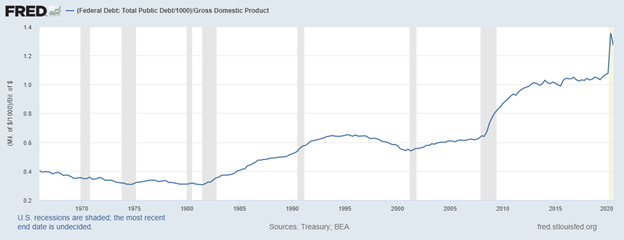

The additional spending is risky because the U.S. federal debt held by the public is already reaching $27 trillion, which is more than 127 percent of the size of the U.S. economy. The U.S. has never reached such fiscally irresponsible debt levels except during times of war. There will be dire economic consequences from this spending.

Federal Government Debt Held by the Public

As a Share of the Economy

1966 – 2020

(monthly data)

So, what’s the outlook going forward, particularly because it seems inevitable that a fiscally irresponsible $1.9 trillion spending package will be approved shortly. At first, things will likely go well. There will be an initial surge in economic activity because this surge is already set to occur in the second half of 2021 and into 2022 (depending upon the success of the vaccine rollout to control the pandemic).

This surge of activity will also set up the U.S. economy for increased economic volatility that will manifest in higher pressure on interest rates, higher inflation, and growing economic distortions. Making this volatility more problematic, just as the economy is “heating up”, President Biden and Congress have indicated that they will push for higher taxes and increased regulation. Adding this policy mix will lead to even more economic dislocations and weaken our long-term growth potential even more.

Righting these trends requires a policy mix of fiscal responsibility and sound money that has been missing in Washington D.C. for far too long. While there is no indication that a better policy mix will be implemented anytime soon, another $1.9 trillion spending blowout will make things worse, not better.

Wayne Winegarden, Ph.D. is a Sr. Fellow in Business and Economics and the Director of the Center for Medical Economics and Innovation at the Pacific Research Institute.