Public banks, it seems, are the next wrongheaded progressive movement in state overrun with them.

The Santa Cruz County Board of Supervisors voted last month “to reach out to nearby jurisdictions proposing a viability study, the first step in the creation of a public bank” the Monterey County Weekly has reported.

The idea is reportedly being floated in Los Angeles, San Francisco, and San Diego, as well. It was enabled, and energized, by the passage of the Public Banking Act, Assembly Bill 857, signed into law in October.

As with all schemes that emerge from the left, public banks are seen as a means to minimize the private sector while continually expanding government. Even The Progressive, a leftist monthly, acknowledges that “the question at the heart of public banking may seem technical but is actually about political power.”

A public bank is defined as a financial institution “owned by a government agency and operated in the public interest.” They are often capitalized by tax dollars. A government can use its financial assets, or it can issue bonds, to raise the initial capital. Public bank start-up costs are significant, says the AB 857 Assembly floor analysis, and there are “high levels of financial and operational risk associated with” them, which means the risks are high for taxpayers.

Public banks activists complain that “corporate banks own and control” public dollars from cities and counties. They use these funds, says the California Public Banking Alliance, “to finance harmful industries including: private prisons, immigrant detention centers, weapons manufacturers, fossil fuel pipelines, and other investments that prioritize corporate profit over the people and the planet.”

Public bank supporters see these institutions as alternatives for those whose loan applications are turned down by private banks. Of course, there’s usually a good reason private banks refuse credit to some applicants and charge high interest rates on some loans. They have to consider a customer’s creditworthiness. If public banks don’t establish a minimum standard and lend to all applicants, they will soon find themselves running out of other people’s money needed to keep the doors open.

History, both and short, show that government intrusion into what should be fully private enterprises is never a good idea in any business sector. With banks, this is especially true.

“The first American public bank was established in Vermont in 1806. It failed six years later, costing the citizens of Vermont the equivalent of almost $3 billion in today’s dollars,” Mark Calabria wrote, director of the Federal Housing Finance Agency, wrote a few years back. “Seven other states established public banks in the 1800s, with the last of these, the Bank of the State of Indiana, closing in 1859.

All “were characterized by rampant corruption.”

In our era we have Fannie Mae and Freddie Mac, congressionally created institutions that are “quasi‐public banks at the federal level,” says Calabria. Their stained records that show “mismanagement and corruption are alive and well at the intersection of the public and private.”

The only state-run, state-operated bank in the nation is the Bank of North Dakota, which has been around more than a century. But its existence does not recommend an expansion of public banks. While it “is generally a well‐run institution,” says Calabria, “it is also a massive subsidy to the fossil fuel industry.”

Is anyone surprised? When government becomes a participant in enterprises that belong in the free market domain, politics inevitably dictate decisions. Politicians rather than consumers choose which companies win and which companies lose.

While the Bank of North Dakota is partial to the oil industry, the dynamic would be exactly the opposite in California. Public banks would finance green energy activities that for-profit banks wouldn’t touch because they’d be too risky. We saw what happened when the Obama administration went all in on renewable energy. Taxpayers lost as much as $100 billion on failed, but government-favored, projects. The same politically driven mistakes would be repeated in California.

Public banks in California wouldn’t stop with green energy, either. They’d pour money into endless progressive causes. Anyone who thinks this is a good idea hasn’t been paying attention to the problems at CalPERS, which is roughly $1 trillion in the hole in part because it’s sunk public employee pensions in “socially responsible” “investments” with poor returns.

Sacramento’s endorsement of public banks should not be understood as an order. Any local government considering opening one ought to take the advice of musician Bob Brozman, who once had engraved “Just because you can, doesn’t mean you should” on one of his guitars.

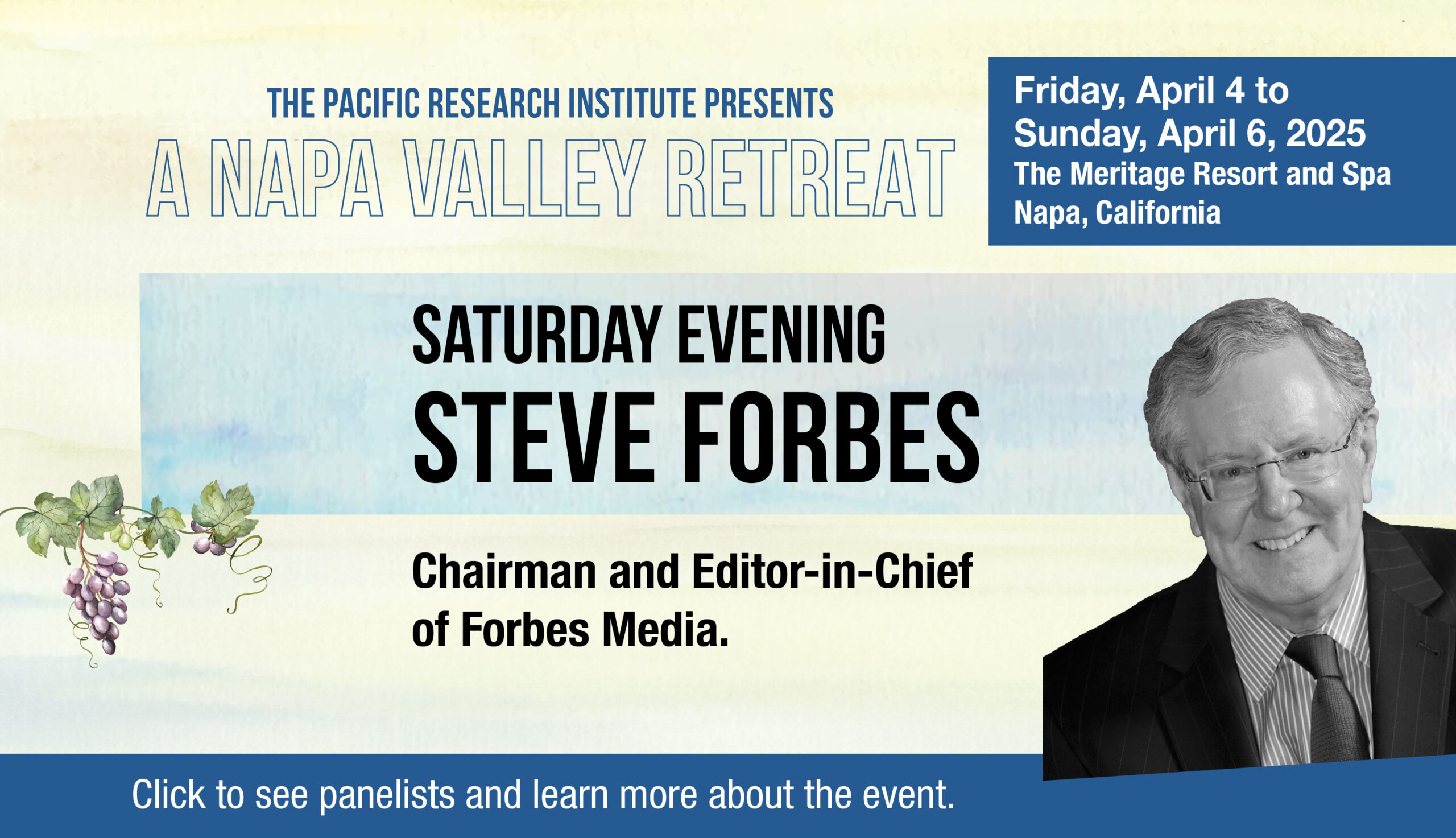

Kerry Jackson is a fellow with the Center for California Reform at the Pacific Research Institute.