Effectively addressing the drug affordability problem requires an understanding of its causes. Toward this end, the rhetoric of Matt Eyles, the president and chief executive of America’s Health Insurance Plans (AHIP), is unhelpful. According to Eyles, “Americans are being hurt by out-of-control drug prices, which are set and fully controlled by Big Pharma alone”. This statement is both factually untrue and theoretically bankrupt.

Let’s start with the facts.

There are two key pricing data for drugs – the list price and the net price. The list prices are announced by manufacturers, but are not the prices that insurers pay on behalf of patients. Insurers negotiate significant concessions and rebates from manufacturers (that equaled $175 billion in 2019) that lower medicines’ list prices. The prices inclusive of these concessions are referred to as net prices, or the prices paid by insurers and received by manufacturers. Since net prices are the total amount of revenues earned by the producer, they more accurately measure the actual market price of drugs.

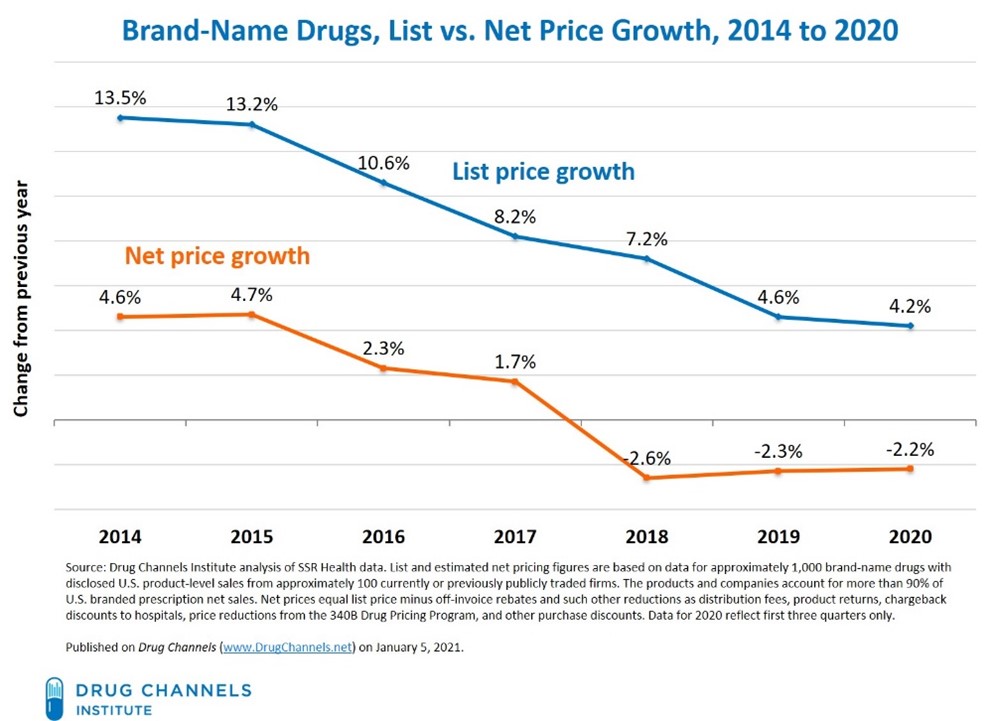

The chart below, from the Drug Channels Institute, tracks the percentage change in list and net prices between 2014 and 2020. Two important trends are evident in the chart.

First, the growth in list prices has moderated significantly over the past seven years. Second, and more important, the growth in the actual market prices of drugs have been moderate. List prices were growing slowly between 2014 and 2017, and have been declining ever since.

First, the growth in list prices has moderated significantly over the past seven years. Second, and more important, the growth in the actual market prices of drugs have been moderate. List prices were growing slowly between 2014 and 2017, and have been declining ever since.

These data raise an important question: If market prices for drugs are declining, why is there a drug affordability crisis? For insurers, there isn’t.

For patients, it is a different story. Patients’ out-of-pocket costs are tied to the inflated list prices, not the actual market prices, which is why patients who require expensive medicines are facing an affordability crisis despite the fact that the market prices of drugs are declining.

As for the theoretical problem, the statement that prices “are set and fully controlled by Big Pharma alone” may be politically wise, but it is economic bunk. As every Econ 101 student is taught, prices are established via the push and pull of supply and demand.

In the case of the drug market, large manufacturers negotiate with large pharmacy benefit managers (PBMs) who are acting on behalf of large insurance companies. There is absolutely no evidence that Big Pharma dominates the negotiations between these multi-billion-dollar companies. In fact, the large and growing size of the concessions paid by manufacturers demonstrates just the opposite – PBMs and insurers wield significant leverage during these negotiations.

The lesson for the Biden Administration is that the affordability problem exists because the current drug rebate system does not allow patients to directly benefit when large concessions are paid on their behalf, and our current health insurance system is ineffective. The sustainable policy solution fixes these problems.

First, drug rebates should directly benefit patients and their costs should be tied to the actual market prices of drugs. Second, broad insurance reforms are necessary to create health insurance that more efficiently moderates the financial risks associated with the cost of ill health.

Not only is the rhetoric from AHIP inaccurate, but it is also counterproductive toward achieving these goals.

Dr. Wayne Winegarden is the director of the Center for Medical Economics and Innovation, and senior fellow in business and economics, at the Pacific Research Institute.