The electric-vehicle tax credit should be taken off the road

Some government foolishness has an educational value that compensates for its considerable cost. Consider the multibillion-dollar federal electric-vehicle tax credit, which efficiently illustrates how government can, with one act, diminish its already-negligible prestige while subtracting from America’s fairness. Sen. John Barrasso, R-Wyo., and Rep. Jason Smith, R-Mo., hope to repeal the tax credit, which probably will survive because it does something that government enjoys doing: It transfers wealth upward by subsidizing affluent individuals and large economic entities.

In 1992, Congress, with its itch to supplant the market in telling people what to build and buy, established a subsidy for buyers of electric vehicles, which then were a negligible fraction of the vehicle market. In 2009, however, as the nation reeled from the Great Recession, the Obama administration acted on an axiom of the president’s chief of staff, Rahm Emanuel: “You never want a serious crisis to go to waste.” Using the crisis as an excuse to do what they wanted to do anyway, those who think government planning of the U.S. economy is a neat idea joined with environmentalists to persuade Congress — persuading it to dispense money is not difficult — to create a tax credit of up to $7,500 for consumers who buy battery-powered electric vehicles.

The tax credit quickly became another example of the government’s solicitousness for those who are comfortable, and who are skillful in defense of their comforts. Today, demand for electric cars is still insufficient to produce manufacturing economies of scale (after a decade of production, moral exhortations and subsidies, electric cars are a fraction of 1% of all vehicle sales), and batteries are expensive. So, The Wall Street Journal reports, the $42,000 average price for an electric car is $8,000 more than the average price of a new car, and $22,000 more than the average price of a new small gasoline-powered car.

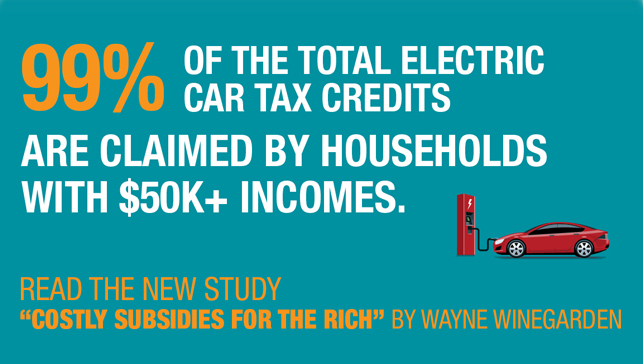

The Pacific Research Institute has examined 2014 IRS data showing that 79% of the electric-vehicle tax credits were collected by households with adjusted gross incomes of more than $100,000, and 1% by households earning less than $50,000. A 2017 survey found that households earning $200,000 received the most from the tax credit . . .