Consumers, Not ‘Polluters’, Would Be Hard Hit by New Climate Tax Legislation

Wayne Winegarden

May 2024

SB-1497, the Polluters Pay Climate Cost Recovery Act of 2024, purports to “require fossil fuel polluters to pay their fair share of the damage caused by the sale of their products…to relieve a portion of the burden from climate harms that is borne by California taxpayers.” The premise of this Act is theoretically flawed. If implemented, it will impose huge costs on Californians.

Theoretical failings undermine the Act’s practicality

The Act attempts to measure the fair share of the damage from fossil fuels by only considering fossil fuel’s negative externality of greenhouse gases. Fossil fuels also create positive externalities, such as improved health and greater prosperity. Any assessment of the damage from fossil fuels cannot perform a partial accounting but must measure both the positive and negative externalities, which the Act does not attempt to do.

The Act also claims that the costs of global climate change have been realized, but most estimates refer to costs that “could” occur in the future.[1] In other words, these are not actual damages that have occurred – they are potential damage estimates that could occur. It is impossible to determine the “fair share” of an unknown cost that will only occur at some later date.

Further, attempts to assign blame to one part of one industry (i.e., U.S. oil producers) will result in tenuous estimates. There are many contributors to emissions both domestically and across the globe. How consumers use fossil fuels also matters. These complexities will confound any attempt to accurately assign the costs of global climate change to the targeted producers.

Due to these inherent problems, the concept that there is a “fair share” of the damage caused by “fossil fuel polluters” is vacuous.

Taxes on fossil fuel producers will impose large economic cost on Californians

Beyond the proposal’s theoretical failings, imposing these costs on fossil fuel producers is economically destructive. While no precise fee has been proposed, presumably the government would devise some type of penalty that depends on the volume of production since that is the relevant nexus.

A government-imposed cost on fossil fuels that increases with output will operate like a carbon tax. This new carbon tax will be in addition to all the state’s other climate programs including the cap-and-trade program that is growing in its stringency, zero-emissions vehicle regulations, renewable energy source requirements, and low-carbon transportation fuels standards.

It is well documented that imposing what is essentially a carbon tax will have dire effects for the state’s economy. Studies typically show that a significant share of the costs from carbon tax proposals such as SB-1497 are passed along to consumers through higher prices.[2] Worst, the higher prices and slower growth will impose larger burdens on lower-income families.

The higher prices will worsen California’s affordability crisis that is driving away families and contributing to the state’s homelessness crisis. It is also ironic that a bill that is supposed to mitigate the “climate harms that is borne by California taxpayers” is imposing large burdens on the very taxpayers who it is supposed to help. Beyond the higher prices, the proposal sends another strong signal to other industries that California is hostile to business.

Numerous studies have examined the economic consequences of implementing a carbon tax. These studies find a negative relationship between more burdensome carbon taxes and economic growth.[3] While studies often estimate that the adverse economic consequences from carbon taxes can be reduced by implementing equivalent broad-based income tax reductions, SB-1497 does not propose any pro-growth tax changes.

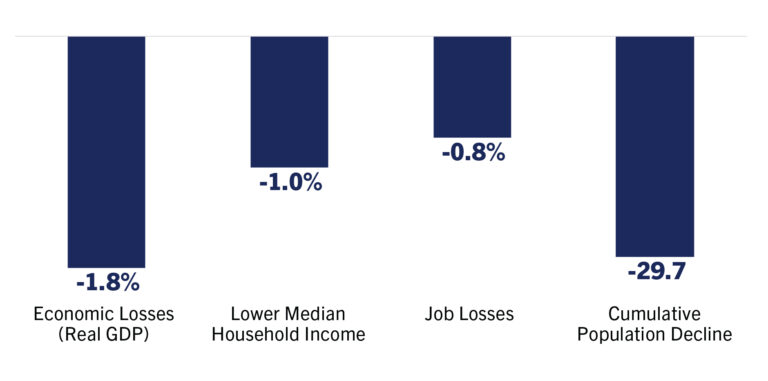

5-Year Economic Losses Compared to Baseline

(population decline in thousands)

The extent of the economic losses to California will depend on the actual penalties the state imposes, which is unknown. To get a sense of the potential impacts, we apply the results from Kanzig (2023) that estimated how the carbon taxes that have been imposed in Europe impacted real GDP. Applying these real GDP losses to California, SB-1497 would, over 5-years, reduce the growth in total economic activity by around $65 billion, dampen average household income growth by $1,120, lower job growth by 213,000, and increase the exodus from California by 29,700 people.

Since a specific cost estimate from the Act has not yet been provided, the estimated real GDP impacts from Europe are applied to provide perspective on the types of impacts that will likely occur. Based on these impacts, Californians should expect large adverse consequences from SB-1497 that include slower economic growth, fewer jobs, and smaller incomes that harm lower-income and working families the most.

[1] See for an example, “Climate Change Impacts in California” Attorney General Rob Bonta, Link (Accessed April 23, 2024).

[2] https://www.haas.berkeley.edu/wp-content/uploads/WP269-1.pdf.

[3] “The Economic Effects of Legislation to Reduce Greenhouse-Gas Emissions” Congressional Budget Office, September 2009, https://www.cbo.gov/sites/default/files/111th-congress-2009-2010/reports/09-17-greenhouse-gas.pdf; McKitrick R and Aliakbari E “Estimated Impacts of a $170 Carbon Tax in Canada” Frasier Institute, 2021, https://www.fraserinstitute.org/sites/default/files/estimated-impacts-of-a-170-dollar-carbon-tax-in-canada.pdf; “Effects of a Carbon Tax on the Economy and the Environment” Congressional Budget Office, May 2013, https://www.cbo.gov/sites/default/files/113th-congress-2013-2014/reports/Carbon_One-Column.pdf; Liadze I, Juanino PS, Millard S, Naisbitt B “Short-term Impact from a Rapid Increase in Carbon Taxes” National Institute of Economic and Social Research, August 9, 2023, https://www.niesr.ac.uk/publications/short-term-impact-rapid-increase-carbon-taxes?type=global-economic-outlook-topical-feature, Kanzig DR “The Unequal Economic Consequences of Carbon Pricing” NBER Working Paper Series, May 2023, https://www.nber.org/system/files/working_papers/w31221/w31221.pdf.

KEY TAKEAWAYS

- Senate Bill 1497’s premise – that companies should be made to pay their fair share of the damage caused by fossil fuels – is fundamentally flawed.

- The proposed fee is essentially a carbon tax. Past studies demonstrate that carbon taxes harm the economy, increase energy costs, and impose the largest burdens on lower-income families who are already struggling with California’s unaffordable cost of living.

- The proposal could reduce economic growth by 1.8 percent, lower the growth in the state’s median household income by nearly $1,120, cost the economy nearly 213,000 potential jobs, and increase the exodus from California by 29,700 people.