Private equity firms are an important source of financing for both new businesses and existing firms. States with more private equity investment experience more business start-ups, more innovation, and generally have a more efficient business sector.

Fortunately, California leads the pack in job-creating private equity investments according to a recent report by the American Investment Council (AIC). AIC annually documents the top states for equity investment and shows how these investments are leading to expanded growth and opportunities. According to the report, private equity firms invested $700 billion in 2019

in diverse communities and industries across the country, helping to rescue, build, or grow 4,841 businesses. Private equity firms provided capital to a broad range of industries, from financial services and healthcare to technology and consumer businesses.

California led the way with $90 billion of new private equity investment in 656 companies. Texas placed second by both metrics with $75 billion invested in 529 companies. Florida ($47 billion; 292), New York ($41 billion; 342), and Illinois ($35 billion; 233) rounded out the top five.

If more private equity investment strengthens a state’s economy, then being the top state bodes well for California. But the amount of private equity relative to the amount of business activity in the state also matters – perhaps even more than standalone investment figures. Afterall, California’s economy is nine times the size of Wisconsin’s, so California having more private equity investment than Wisconsin is not surprising. It is expected.

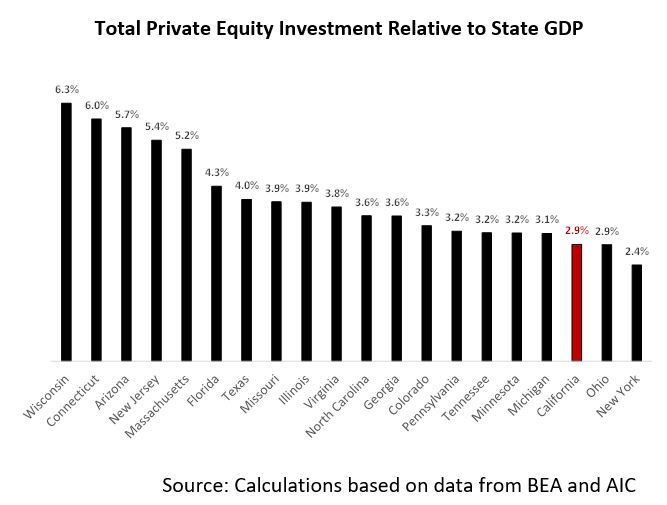

But, something happens when the AIC’s private equity investment is adjusted for the size of each state’s economy. Once the 20 states with the highest amount of private equity in total dollars are adjusted for the size of its economy, California is no longer number one. Nor is it number two.

In fact, total private equity investment in California falls to number 18 once the equity investment is viewed relative to each state’s economy. As the Figure below illustrates, relative to the size of each state’s economy, Wisconsin receives the most investment.

California’s underperformance based on equity investment relative to the size of the state economy is troubling given its history of being one of the nation’s most important business incubators. Troubling, but not surprising, given that the state has the highest regulatory burden in the nation by many estimates.

California’s large regulatory burden makes it more difficult to start a business in the state, and more costly to run it once the company has been established. These competitive disadvantages are an important reason why California’s ranking falls so precipitously once the size of each state’s economy is considered.

There are important lessons from the AIC study. First, policymakers should not be fooled by statistics that are narrowly true, but lack perspective. It is simply not useful to compare the total private equity dollars invested in California to the total invested in most other states. Such comparisons ignore the fundamental differences between the states.

Second, once the size of the different states is considered, the amount of private equity invested in California is underwhelming. Reversing this trend requires reforms that should include broad-based deregulation that lowers the relative cost of doing business in California.

If done well, deregulation would encourage a surge in private equity investment in the state which in turn would strengthen job and income growth. While valuable anytime, given the headwinds created by the coronavirus recession, the growth benefits from deregulation are particularly valuable today.

Dr. Wayne Winegarden is senior fellow in business and economics at the Pacific Research Institute.