Backfilling Lost Federal Education Funding Will Cost California Dearly

Wayne Winegarden

February 2025

The erratic actions of the Trump Administration are undoubtedly making it more difficult for states to budget for the upcoming 2026 fiscal year. The knee-jerk reaction from many California politicians is to call for more taxes on the rich to backfill any funding reductions from the federal government. As reported by Politico, current state school superintendent and Gubernatorial candidate Tony Thurmond is following this playbook when it comes to federal education funding.

According to Politico, “Thurmond, who is running in a crowded 2026 race for governor, estimates that California would lose $9 billion in funding for schools if the DOE [federal Department of Education] is eliminated, a higher figure than the $8 billion that the state had projected in December.”[1] In response to these losses, he suggested that “Maybe we’ll put our own tax program together and tax those wealthy Californians to … put the money back where it belongs — back in public education.”[2]

Understanding the economic consequences from this proposal is imperative, especially because the superintendent is neither the first, nor the last, politician who will call for more taxes on the rich to cover lost federal funds.

In the 2025-26 fiscal year, the state is expecting $170.6 billion in federal funds from Washington, which equals about 53 percent of the total revenue the state will raise ($322.3 billion).[3] To get a sense of the impossibility of raising this much revenue, arithmetically it would take a 5-percentage point increase in the state sales tax, the state corporate income tax, and across every bracket for the personal income tax to raise around $170.6 billion. California would suffer a fiscal and economic crisis of epic proportions should it try to impose a state sales tax of over 12 percent, a near 14 percent corporate income tax, and an 18.3 percent top personal income tax rate (the lowest rate being 6 percent).

KEY TAKEAWAYS

- California’s state school superintendent Tony Thurmond proposes to tax wealthy Californians to backfill the $9.0 billion in education funds the state could lose if current U.S. Department of Education funding earmarked to California be eliminated.

- Raising $9.0 billion on the “wealthy” as Thurmond proposes would require a 1.5 percentage point increase in the tax rate for filers in the 9.3 percent bracket and above (single filers with an income above $70,607 and married filers with income over $141,213). California’s top state and local personal income tax rate of 14.8 percent would become the highest in the nation, overtaking New York City’s 14.776 percent rate.

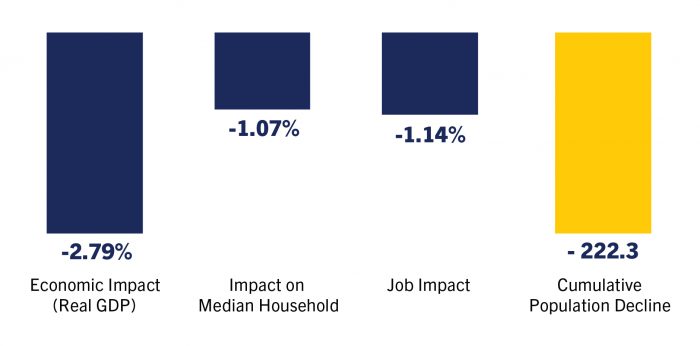

- The economic consequences would be severe. Compared to baseline growth over five years, nearly 223,000 additional people would leave the state, economic growth would decline by 2.8 percent, employment growth would decrease by 1.1 percent, and the median family’s income would by nearly $1,300 smaller.

As a practical matter, replacing the lost federal funds should significant reductions in this revenue source occur is unrealistic. The state will have to figure out how to do more with less.

More relevant, eliminating the Department requires Congressional action. Legislation proposed by Senator Mike Rounds (R-SD) to abolish the Department of Education would transfer key support programs (such as the programs associated with the Individuals with Disabilities Education Act and the Office of Indian Education) to other agencies and transform other federal spending into block grants to the states. The block grants would help fund elementary and secondary education including career and technical training and would empower state leaders to direct these expenditures.[4] Therefore, it is highly improbable that California will lose $9 billion in federal education funds, or even anything close to this amount.

While education funds may not be appreciably reduced, a reduction in federal funds to the state is a real possibility. Superintendent Thurmond’s proposal to tax the rich to raise $9 billion for education funds provides a useful benchmark, consequently, regarding the economic consequences to California should state leaders attempt to backfill these revenues.

Presumably, when the superintendent is calling for taxes on the rich, he wants to raise the top marginal personal income tax rates. To attempt to quantify the impacts from this policy suggestion, this analysis assumes that taxing the rich refers to households in the 9.3 percent tax bracket and above (single filers with an income above $70,607 and married filers with income over $141,213). For simplicity, the analysis also assumes that the same tax rate increase is applied to all the top tax brackets. Altering this formula to put a larger tax increase on the higher rates would alter the specifics but not materially change the broader impacts.

5-Year Economic Losses Compared to Baseline

(population change in thousands)

Source: Author calculations based on data from U.S. Census Bureau

Based on these assumptions, a 1.5 percentage-point increase in the 9.3 percent tax bracket and above would raise approximately $9 billion – enough revenue to replace the lost federal funds. It would also mean that California’s top marginal income tax rate would increase to 14.8 percent, which would be the highest top state and local personal income tax rate in the nation, overtaking New York City’s 14.776 percent rate.

The economic consequences from imposing such a large state and local income tax rate would be severe. Compared to our baseline economic performance expected over the next five years as defined in PRI’s Tax and Budget Model, California’s economy would be 2.8 percent smaller. A less vibrant economy would mean fewer new jobs created. Overall, the state would create 1.1 percent fewer jobs, a loss of almost 304,000 jobs. The slower growth and fewer job opportunities would also take a toll on the average family’s income. Overall, the median household’s income would be nearly $1,300 smaller. The less vibrant economy would also exacerbate the state’s outmigration problem with an estimated 223,000 offshore additional people leaving the state if the proposed policy were implemented.

These impacts should cause policymakers to pause before suggesting large tax increases to backfill lost federal revenues. Rather than increasing the tax burden, California’s leaders should focus on budget prioritization and reforms that improve efficiency. For example, should the state be spending billions of dollars on inefficient and costly offshore wind turbines,[5] or are these funds better allocated toward education? Similarly, the California High Speed Rail Authority projects that the newly revised costs of the project exceed secured funding by $10 billion.[6] Is spending billions more for this ill-fated project the best use of scarce resources?

Federal fund volatility is an issue that state governments across the country will have to manage. The most effective way to manage this issue is for policymakers to find and embrace the opportunities for greater spending efficiencies across the government to improve the quality of public services without increasing the burden on the already over-taxed citizenry.

[1] He E “California schools chief floats new tax on the wealthy if Trump cuts the Department of Education: The state could lose $9 billion in funding for schools, according to Superintendent Tony Thurmond.” Politico Pro, February 11, 2025.

[2] Ibid.

[3] https://dof.ca.gov/wp-content/uploads/sites/352/2023/03/CHART-B.pdf.

[4] The bill introduced in the 118th Congress (2023-2024) was S.5384 – Returning Education to Our States Act, https://www.congress.gov/bill/118th-congress/senate-bill/5384.

[5] Lazo A “Legislators unveil measure to ask voters for $1 billion offshore wind bond” CalMatters, February 8, 2024, https://calmatters.org/environment/2024/02/ -wind-bond-california/.

[6] Vartabedian R “New cost estimate for high-speed rail puts California bullet train $100 billion in the red” CalMatters, March 7, 2023 Updated May 24, 2023, https://calmatters.org/economy/2023/03/california-high-speed-rail/.