Low-Cost Biosimilars Are Saving Billions, Potential Savings Are Even Greater

By Wayne Winegarden | October 28, 2024

Executive Summary

- Since 2019, biosimilars have obtained a majority share of most markets where they compete.

- The combination of lower prices (both biosimilar and originator) and rising market share could have generated up to $35 billion in savings in 2024 dollars compared to an all-originator baseline based on PRI’s latest analysis.

- These savings demonstrate that, just like with small molecule medicines, biosimilars strike a beneficial balance between incentivizing innovation and promoting affordability.

Lower-cost Biosimilars Are Gaining Market Share

The share growth of lower cost biosimilars is well documented. PRI’s latest assessment of the biosimilars market evaluated the biosimilar competition with ten oft-prescribed originator biologics excluding insulin. The results found that the market share of lower cost biosimilars increased from a bit under 8 percent of total units sold in 2019 to nearly 36 percent of all units sold through February 2024 – an over four-fold increase.

The growth in biosimilars’ market share is even larger when only the markets where there is biosimilar competition are considered. In these markets biosimilars grew from a bit over 14 percent of all units sold to now comprising over two-thirds of the market for the eight biologics where actual competition is occurring (excluding Enbrel and Humira sales where no or de minimis biosimilar sales occurred through February 2024, respectively).

Growing Market Share Generates Significant Healthcare Savings

The growing market share for biosimilars generates healthcare savings through two inter-related competitive processes. First, simple arithmetic dictates that a growing market share of lower-cost medicines will generate savings relative to the expenditures that would have occurred without competition. Second, the competitive pressures from low-cost biosimilars encourage the originator biologics to cut their prices. Both competitive processes generate healthcare savings.

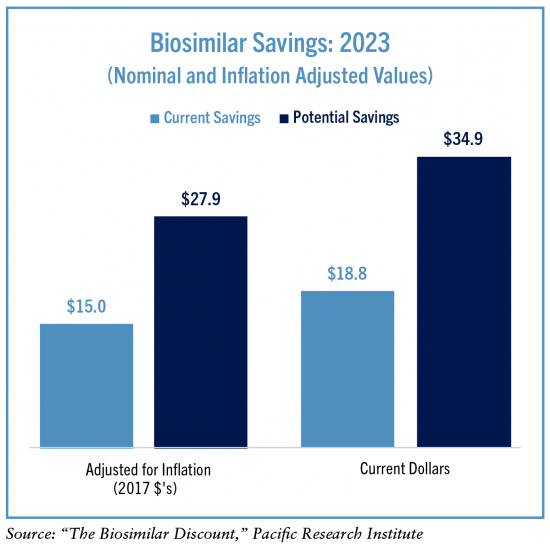

The current realized and potential savings enabled by competition can be estimated by comparing the total spending on biologic medicines including biosimilar competition to a baseline originator-only scenario. The prices for originator biologics have consistently grown when no biosimilar competition exists. Assuming prices would continue to grow at their pre-competition pace while total sales would have been the same, then the current biosimilar competition has generated $15 billion in savings accounting for inflation ($19 billion in current dollars).

Had biosimilar competition existed for Humira and Enbrel, and assuming the pricing and market share trends would have followed the average for all other biologic markets, then the potential savings that could have been realized was $28 billion accounting for inflation ($35 billion in current dollars).

Other analyses similarly find that biosimilars generate large savings. IQVIA, for instance, examined the savings over a longer timeframe, estimating that biosimilars saved $25.5 billion (compared to the PRI estimate of $19 billion) in 2023.1 Between 2023 and 2027, IQVIA estimates that the cumulative biosimilar savings under their base case analysis is $181 billion.2

Striking the Balance Between Innovation and Affordability

Unlike regulations and price controls, biosimilars generate sustainable savings without jeopardizing the benefits from future biologic innovations. And new and better treatments for many diseases such as Alzheimer’s, pancreatic cancer, and muscular dystrophy are desperately needed. Policies, such as price controls, jeopardize continued innovations that could provide patients with new and better treatments because they inhibit innovators’ ability to cover their costs of capital.

Biosimilar competition generates significant savings while still providing innovators with an opportunity to cover their costs of capital. This opportunity, while it is not a guarantee, has helped incentivize the amazing innovations that have been achieved.

The Bottom Line

A pro-patient market for medicines strikes a careful balance. First, it provides an opportunity to cover the expensive capital costs required to develop innovative medicines. Second, once this opportunity has been provided, the market then promotes competition to generate cost savings.

Biosimilars have demonstrated that they strike this crucial balance for the innovative biologics market. Incentivizing a vibrant biosimilars market creates a competitive environment that helps lower prices today while still maintaining the incentive to develop new therapies that will improve patients’ health outcomes tomorrow. They represent the quintessential win-win policy.

1. “Biosimilars in the United States 2023-2027: Competition, Savings, and Sustainability” IQVIA, January 31, 2023, https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications/reports/biosimilars-in-the-united-states-2023-2027.

2. IBID.