A century ago, the federal government involved itself hardly at all in housing, leaving that to state and local governments, and the market. The major exception was housing on federal land, including the District of Columbia, other territories and military bases. That changed in 1937 when, as part of President Franklin D. Roosevelt’s New Deal, Congress passed the Wagner-Steagall Housing Act, which established the United States Housing Authority.

According to the FDR Library, by 1940 “over 500 USHA projects were in progress or had been completed, with loan contracts of $691 million.” When the U.S. became involved in World War II, the USHA took over most housing construction for the military and defense construction workers.

The feds never stopped meddling. In 1965 the USHA was promoted to Cabinet status as part of another burst of federal welfare expansion, President Lyndon Johnson’s Great Society, and renamed the Department of Housing and Urban Development. A third vast expansion is unlikely to occur under Vice President Kamala Harris should she be elected president. For one thing, the federal government already meddles so much in housing, it’s hard to see it doing more, although creative bureaucrats surely could think up ways.

Let’s look more closely at two of her proposals and their effects on cities.

In May, while still running only for vice president, she undertook a nationwide Economic Opportunity Tour, promoting $5.5 billion in grants to 1,200 communities to “build and preserve homes, lower housing costs, support renters and homeowners, aid people experiencing homelessness, create jobs and improve public facilities and community resilience.”

“Homeownership is an essential part of the American Dream that represents so much more than a roof over our heads,” she said, using the “American Dream” cant of all politicians in both parties, of which the California Dream is a Golden State permutation. “For people all across our nation, a home represents financial security, the opportunity to build wealth and equity, and a foundation for a better future for themselves, their children and future generations.”

Some details. She links to the Biden-Harris administration’s Blueprint for a Renters’ Bill of Rights. Its First Principle: “Renters should have access to housing that is safe, decent and affordable and should pay no more than 30% of household income on housing costs.” If Harris were serious about this, she would be calling for ousting her fellow Democrats who run California, beginning with Gov. Gavin Newsom, for failing to dismantle or reform such ultra-anti-housing monstrosities as the California Environmental Quality Act (CEQA) and the California Coastal Commission.

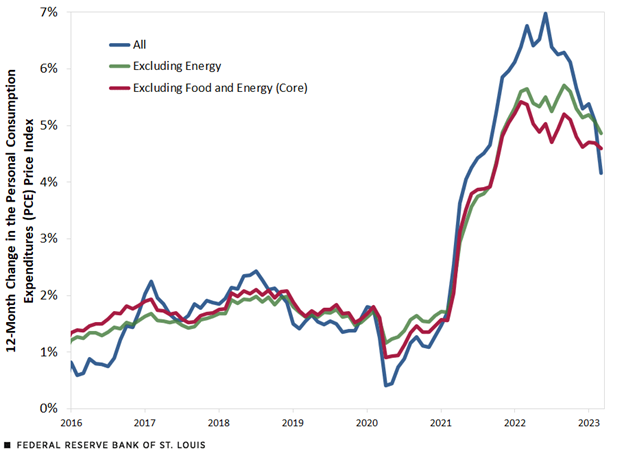

Instead, she boasts the American Rescue Plan Act provided $33 billion in rental assistance, “subsidies for new housing supply” and “resources for fair housing and legal counsel” – that is, attacks on landlords’ property rights. The ARPA, effective in March 2021, blew $1.9 billion in supposed “COVID relief,” even as the pandemic was subsiding and everybody who survived returning to work. That contributed mightily to the high inflation of subsequent years. It goosed apartment and house prices and caused the Federal Reserve Board in turn to increase interest rates, making housing even less affordable.

To be sure, President Trump increased the debt $8 trillion overall, half for his own COVID relief schemes, the same $8 billion total for the four years of the Biden-Harris administration. That just goes to show what economist Ludwig von Mises described in his book, “A Critique of Interventionism”: Government intervention in the economy inevitably leads to more intervention.

Second, in recent months Harris has endorsed a Biden plan to tax unrealized capital gains for stocks. Under current law, capital gains only are taxed once a stock is sold. (Although unlike for income, the cap gains tax is not indexed to inflation, which discourages investment.) The new tax would apply every year to the capital gain, even if the investment is not sold.

However, on Aug. 29 NBC News reported Harris modified the proposal to apply only to those with net worth more than $100 million, who would pay a 25% yearly tax on the gains. Effectively, it would be a wealth tax. As the story noted, the Supreme Court, in the recent case Moore v. United States, suggested any wealth tax, if imposed, well could be unconstitutional.

Unless exempted by Congress, the tax would hit those with large investments in real estate. The obvious result would be to discourage such investments. Indeed, capital, and the rich people owning it, would be more inclined to flee America, much as Elon Musk’s Tesla and SpaceX and Chevron recently have fled California.

As Heritage Foundation research fellow Preston Brashers warned on Aug. 30, “It would give the government the first claim on income, taking a big slice before the supposed owner of the asset ever sees a penny. In effect, it would turn property owners into property renters, with Uncle Sam as their landlord.”

He points out the tax would be imposed even on unrented properties. At first, that might encourage lowering rents to fill up the units. But as with rent control, such a confiscatory policy would discourage upkeep and renovations. This will obviously harm urban markets the most.

I rent a tiny efficiency from The Irvine Company. The company recently spent nine months sprucing up the grounds around the community. It was noisy and a nuisance, but worth it because the place looks nicer, instead of like my native Detroit. If Donald Bren, the largest stockholder in the company, currently worth $17.4 billion, had to pay a 25% tax every year when the value of his holdings rose, why would he put money back into his investment?

Such a Harris tax also would encourage speculation similar to the gambling that ran wild just before the 2007-08 subprime meltdown. To cover that 25% tax, wealthy people would have to make more than steady gains of 5% to 10% or so a year, instead gambling on much higher returns – as happened with real estate’s speculative bubble in the years leading up to 2007.

In short, Harris’ housing plans would, if enacted, produce chaos in the housing market, leading to pandemonium for cities and their revenue sources.

John Seiler is on the Southern California News Group editorial board and blogs at: substack.johnseiler.com.