Biosimilars Often Reduce Prices by 50 Percent or More

By Wayne Winegarden | October 1, 2024

Executive Summary

- In the competitive biologic markets, biosimilars have reduced average prices by 56 percent.

- The lower prices have reduced total expenditures by 51 percent in the competitive biologic markets even though total use is higher.

- Developing biosimilars is a long and costly endeavor that can take up to 9 years and $300 million. Market conditions should encourage uptake and appropriate reimbursement for physicians and manufacturers.

Biologics – innovative medicines made, or derived, from biological processes – treat devastating diseases such as autoimmune disorders and cancers. To encourage the development of originator biologic medicines, the creators of novel treatments receive exclusivity rights for an established period. This period provides an opportunity, but not a guarantee, for the developer to recover their incurred capital costs (an average of $2.9 billion including post-approval studies).[1] Providing the opportunity to cover these costs is essential for incentivizing continued medical innovation.

Biosimilars Reduce Costs

Like generics in the market for traditional medicines, the role of biosimilars is to introduce competition, and thus lower prices for biologics once the exclusivity period for the reference medicine has ended.

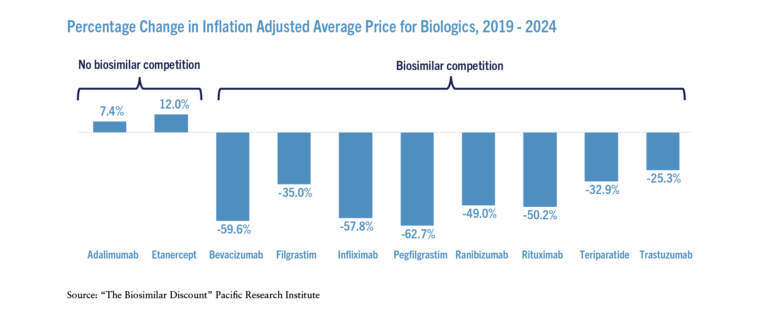

Adjusting for inflation, the average prices for biologics that faced biosimilar competition declined significantly over the past five years (see the Figure) – on a weighted average basis, prices declined 56 percent. In contrast, the inflation adjusted prices increased for those biologics that did not face effective biosimilar competition.

The stark differences in price and expenditure changes between the originators facing biosimilar competition and those not facing competition provides evidence that competition from biosimilars drives down prices. Thanks to biosimilar competition, total inflation adjusted expenditures on the biologics that faced competition were 51 percent lower in 2023 than they were in 2019 even though the total units sold increased.

This experience is consistent with the findings of many other evaluations of biosimilars’ impact on price. For instance, the Association for Accessible Medicine notes that, [2] “biosimilar average sales prices today [in 2023] are more than 50 percent lower than the brand biologic price at the time of biosimilar launch. And brand prices are also lower—more than one-quarter lower since biosimilar market entry.”

Creating Biosimilars Requires Substantial Investments

Undoubtedly biosimilar competition has generated significant savings where it has been allowed to flourish; however, unlike generic medicines, developing competitive biosimilars still requires substantial investments of time and money. A 2021 analysis of the biosimilars market by McKinsey & Company noted that “a typical biosimilar costs $100 million to $300 million to develop and takes six to nine years to go from analytical characterization to approval. Clinical trials account for more than half of both budgets and timelines.”[3]

The cost of producing an authorized generic medicine is significantly cheaper than producing a biosimilar. A study performed for HHS estimates that “the average cash outlay” for a generic applicant “is around $2.6 million”.[4]

Due to biosimilars’ much larger investment requirements, the competitive prices that are expected to result will not be as low as the typical prices for generic medicines. Therefore, while robust generic competition has been associated with price declines of up to 95 percent or more compared to the branded drug,[5] biosimilar discounts are expected to be between 50 percent and 60 percent.[6]

The Bottom Line

Biosimilar medicines introduce competition into the high-value biologics market. When biosimilar competition is allowed to flourish, the competitive process drives down prices and total healthcare expenditures. Consequently, biosimilars reduce the prices on costly medicines that efficaciously treat many devastating diseases and are an effective way to generate large healthcare savings.

[1] DiMasi JA, Grabowski HG, Hansen RW. Innovation in the pharmaceutical industry: New estimates of R&D costs. J Health Econ. 2016 May; 47:20-33. doi: 10.1016/j.jhealeco.2016.01.012. Epub 2016 Feb 12. PMID: 26928437.

[2] “The U.S. Generic & Biosimilar Medicines Savings Report” Association for Accessible Medicines, September 2023, https://accessiblemeds.org/sites/default/files/2023-09/AAM-2023-Generic-Biosimilar-Medicines-Savings-Report-web.pdf.

[3] “Three imperatives for R&D in biosimilars” McKinsey & Company, August 19, 2022, https://www.mckinsey.com/industries/life-sciences/our-insights/three-imperatives-for-r-and-d-in-biosimilars.

[4] “Cost of Generic Drug Development and Approval” Eastern Research Group Submitted to U.S. Department of Health and Human Services Office of the Assistant Secretary of Planning and Evaluation, December 31, 2021, https://aspe.hhs.gov/sites/default/files/documents/66e13df52a6d314ba4e10c8e55b68b4b/cost-of-generic-drugs-erg.pdf.

[5] Conrad R and Lutter R “Generic Competition and Drug Prices: New Evidence Linking Greater Generic Competition and Lower Generic Drug Prices” U.S. Food and Drug Administration, December 2019, https://www.fda.gov/media/133509/download#:~:text=With%20four%20competitors%2C%20AMP%20data,using%20invoice-based%20drug%20prices.

[6] “2023 U.S. Generic and Biosimilar Medicines Savings Report” Association for Accessible Medicines, https://accessiblemeds.org/resources/reports/2023-savings-report; and Winegarden W “The Biosimilar Discount” Pacific Research Institute, Center for Medical Economics and Innovation, June 2024, https://medecon.org/wp-content/uploads/2024/06/Biosimilars_June2024_rF.pdf.