The Governor’s Special Session Will Worsen Gasoline Affordability

Wayne Winegarden and Kerry Jackson

September 2024

The special session called by Governor Gavin Newsom is supposed to save Californians from price gasoline spikes. The governor wants to blame the price spikes on greedy corporations. His accusations are merely a diversion from the actual culprits – politicians in Sacramento. Instead of alleviating consumers affordability problems, the special session may inevitably prove Gideon Tucker’s maxim that “no man’s life, liberty, or property are safe while the legislature is in session.”

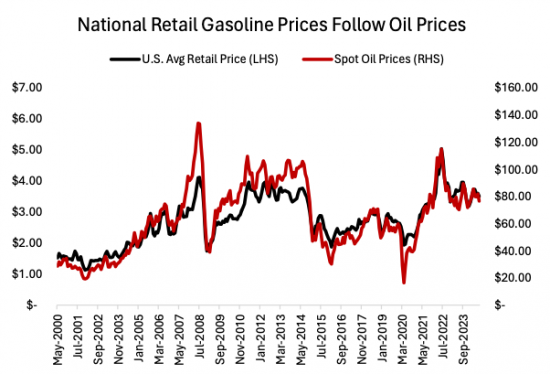

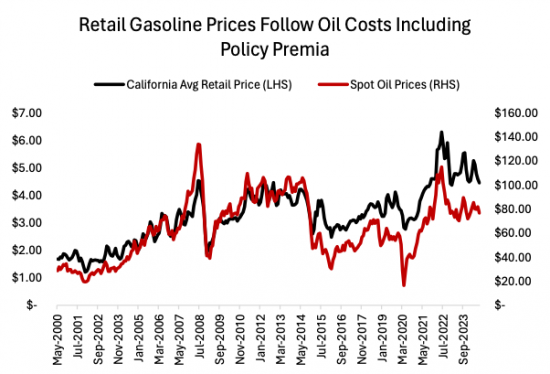

To see why, let’s start with the actual price data – something Newsom’s political grandstanding continues to ignore. The two charts below compare the price of oil to the average gas prices in the U.S. and California between May 2000 and August 2024.

The charts demonstrate the commonsense outcome that national gas prices follow changes in the cost of oil. Period. When oil prices spike up, so do gas prices. The reverse holds as well – when oil prices fall, gas prices decline.

KEY TAKEAWAYS

- California’s expensive and volatile gas prices are the consequences of numerous green mandates enacted over the past decade by lawmakers.

- Depending on how much additional gas storage is required and how much infrastructure is required to be purchased, the Newsom special session gas proposal could increase gas prices between 3 and 11 cents per gallon according to PRI’s calculations.

- An 11-cent increase in gas prices would cause California’s economy to lose $1.4 billion in potential growth in the first year of implementation, and $18.5 billion compounded by the 10th

This pattern also holds in California, but there is an important caveat. Sometime in 2015, the relationship between oil prices and average gas prices in the Golden State changed. Gas prices still closely follow changes in oil prices, but prices began reflecting higher fixed costs. Consequently, oil price declines do not decrease California gas prices as much as they once did. Perhaps more disconcerting for consumers, since 2015 gas prices now rise higher in response to oil price shocks.

Newsom is trying to argue that the now higher oil prices are the work of greedy oil companies. The problem with this explanation is that it is a uniquely California phenomenon. If oil companies were price gouging consumers, then why only Californians?

By raising accusations of price gouging, the Governor is simply following the reflexive response of Democrats when the predicted consequences from their policies come home to roost. In the case of gas prices in California, high and volatile prices are the expected consequence from the web of climate- and environment-related legislation that political leaders have been piling on consumers for more than a decade.

The California Energy Commission, for instance, recognizes that the state’s climate policies cause retail prices to be higher. Tallying up all the taxes and regulatory costs, the Commission estimates they add $1.40 to every gallon of gas. Breaking down these costs, the environmental programs add $0.50, the state excise tax adds $0.60, the federal excise tax adds $0.18, state and local sales taxes add $0.10, and the state underground storage tank fee adds $0.02.

The environmental programs include a wide range of mandates including

- California’s first cap-and-trade law that took effect in 2013 and was extended in 2017 through 2030.

- Assembly Bill 32, known as the Global Warming Solutions Act, set a low-carbon fuel standard (LCFS) that has become progressively stricter since first enacted in 2006. It is important to note that the LCFS has yet to do its worst damage. The California Air Resources Board is scheduled to hold a public hearing on Nov. 8 to consider “additional modifications” for proposed amendments that would make fuel prices even more unaffordable.

- California’s required gasoline blend that burns cleaner than the fuel used in other states. This adds another 10 to 15 cents per gallon.

This brings us to the Special Session. Newsom and proponents claim that imposing a higher minimum oil reserve requirement on fuel refineries will fix the gas price spikes that the state periodically endures. Their argument is that refineries maintain insufficient inventories. With these insufficient inventory levels, when maintenance issues or production snags arise, they can disrupt oil supply and cause prices to spike. Consequently, minimum inventory mandates (presumably above the 2 weeks the industry generally maintains already) are required.

Their argument is flawed because supplies are artificially tight due to the state proliferation of state mandates. Further, policymakers are ignoring the large costs required to maintain higher inventories.

History shows that adding more mandates raises gasoline prices. In this case, the mandate will force refineries to invest in expanding their storage capacity and then spend more resources to manage these higher inventories. These added costs will increase the price of gasoline guaranteeing that consumers will pay more, not less as the governor asserts.

How much more will consumers pay? That is unknown because the actual mandates that will be implemented are still undecided. The amount of new storage capacity that will be needed is, consequently, unclear as well.

Another real-world complication the legislature is failing to consider is that storage capacity is maintained by individual refiners. The required investments will likely impact different refiners differently, potentially harming the competitive landscape and risking a reduction in the state’s refining capacity.

Assuming new tanks are required, and just accounting for the static costs of purchasing additional storage capacity, filling the inventories, and maintaining the inventories, the costs will mount quickly. Should one additional week of storage be required, then these costs are the equivalent of a 3-cent per gallon increase in the cost of gasoline.[1] A requirement to increase capacity by 4 weeks would increase costs by the equivalent of 11-cents a gallon.

Not only is increasing the price of gasoline antithetical to the purpose of the program, but it will also harm economic growth. For instance, based on a study of the impact of gasoline prices on the GDP growth of advanced nations,[2] an 11-cent increase in gas prices would cause the California’s economy to lose $1.4 billion in potential growth in the first year of implementation. The costs will then compound over the years, risking lost economic growth of up to $18.5 billion by the 10th year.

Rather than recognizing their role in causing the pain at the pump, Newsom wants to double down on his detrimental policies by unjustifiably claiming that companies are price gouging. So long as democrats fail to recognize the obvious – that California’s climate policies are responsible for the state’s unaffordable and volatile gasoline prices – legislative action will continue to make the problem worse. Consumers, particularly low-income families, will pay the heavy price.

[1] The cost estimates include the costs of purchasing additional storage facilities financed over 10 years at the Baa corporate bond rate, the costs of maintaining inventory in an above ground storage, and the costs of producing fuel for storage rather than for sale.

[2] https://www.sciencedirect.com/science/article/abs/pii/S014098832200247X.

Dr. Wayne Winegarden is a senior fellow in business and economics at the Pacific Research Institute. Kerry Jackson is PRI’s William Clement Fellow in California Reform.