This exodus reflects the migrant’s view that California no longer offers a competitive lifestyle, and the state provides residents with inadequate economic opportunities. But the exodus from the state is not simply a statement on the Golden State’s current maladies. When people migrate, they take their income and economic activity with them. These losses are no longer insignificant. In 2021, the IRS SOI migration data estimate that California lost adjusted gross income (AGI) worth $20.2 billion. The AGI losses in 2022 were a higher $24.0 billion.

The LAO analysis focused on the implications that this lost economic activity has on California’s personal income tax revenues. According to the LAO, the lost AGI translated into reduced personal income tax revenues of 1.6 percent in 2022, or approximately $2.1 billion. These losses dwarfed the impacts from migration on tax revenues back in 2013, which was a loss of 0.5 percent of revenue, or approximately $341.5 million.

While these impacts illustrate that California is enduring substantial economic and tax revenue losses due to the net out-migration of people, they are also an incomplete accounting.

The IRS data provides insights on the losses that are endured based on those taxpayers who left a state in the given year being examined. This makes sense based on what the IRS is attempting to measure – how many taxpayers migrate from state to state in any given year and how much AGI those taxpayers earned. Focusing only on the one-year losses severely underestimates the exodus’ impact, however.

Most people who left California in 2021 continued to earn income in 2022. Had they remained Californians, then their 2022 income would have benefited the state. The same logic holds for those residents who left in earlier years too. Thus, while the IRS SOI data focuses on the AGI migration that occurred in a specific year, the lost income from past years also matters from an economic impact perspective. This lost income does not continue in perpetuity of course but neither is it correct to assume that the emigrants would have stopped earning income as soon as they left the state.

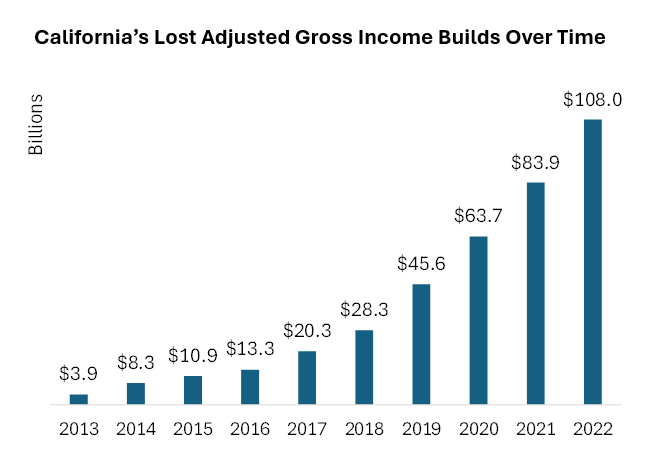

To get a sense of how much economic activity California has lost, the following figure sums together the AGI that migrated away from the state, on net, over the last 10 years. As the figure illustrates, if the people who migrated to other states simply maintained their current income, on average, then economic activity in the Golden State would be $108 billion higher than it was in 2022.

The cumulative losses over time will also impact state income tax revenues. Applying the LAO’s estimated percentage income tax revenue losses to the actual income tax revenues for each year between 2013 and 2022, California’s income tax revenues could have been $8.1 billion higher had the net migration away from the state not occurred. To put this lost revenue in perspective, without the migration induced revenue losses, the state’s recent budget crisis would have been more than 10 percent smaller than it was.

As if these costs aren’t large enough, there are also unseen economic impacts that may be the largest losses of all.

California has traditionally been a vibrant technology incubator that has consistently introduced “the next” transformative innovation to the world. There is no defined recipe for inventing the future. These inventions arise from organic interactions between workers, investors, and entrepreneurs that are as varied as the innovations they create. The exodus from California denies the state of some of the human talent that is essential for developing these novel ideas.

With less talent, the ability of California to maintain its status as the world’s cutting-edge economy is diminished. Fewer opportunities for organic interactions will occur in the Golden State and it becomes slightly less likely that the next transformative innovation will be created and developed in California. Consequently, the growing exodus of people, not to mention businesses, to states like Florida, Texas, and Utah makes it more likely that the next great technology has left with them. While quantifying these lost opportunities is exceptionally difficult, the costs imposed on Californians are no less real.

Documenting the adverse impacts that are caused by the migration away from California is essential. However, it is equally essential to acknowledge that these losses are not one-time events. The exodus imposes long lasting costs on the state’s economy that, when recognized, demonstrates why fundamental reforms are necessary.

Dr. Wayne Winegarden is a senior fellow in business and economics at the Pacific Research Institute.