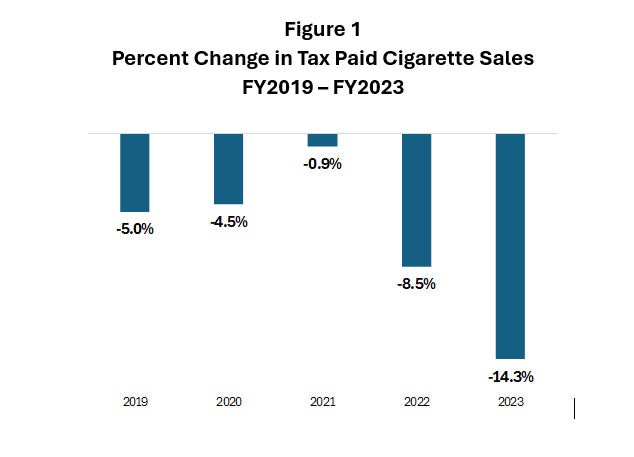

Examining state tax revenues and the volume of legal cigarette sales, it appears that the ban has caused cigarette use to decline. As Figure 1 illustrates, the decline in tax paid cigarette sales accelerated in 2023 following the implementation of the ban. Lost sales translate into lost tax revenues for the state. Compared to the average monthly tax revenues prior to the ban, tax revenues are now approximately 22 percent lower, or the equivalent of a $341 million in annual revenue loss to the state.

Perhaps the lost revenues could be justified if the policy was achieving its goal, which is to eliminate the use of flavored tobacco products. Assuming for the moment that the goal is worthwhile, the policy is a failure because the use of flavored tobacco products continues. Not only is flavored tobacco use continuing, but it is also continuing at around the same levels as before the ban.

In August 2023, WSPM Group released a survey of empty packs in California that was taken between May 1 and June 28, 2023.[1] The survey found that menthol or menthol-like cigarettes comprised 21.1 percent of the total packs collected. This is similar to the share of people who smoked menthol cigarettes prior to the ban – 24.5 percent.[2] Therefore, the ban is failing to meaningfully achieve a core goal – reducing the use of menthol cigarettes.

The reality that people are still consuming menthol cigarettes despite the ban raises serious questions regarding the wisdom of maintaining the ban. Adding to these concerns, the survey indicates that the ban is worsening the use of smuggled and illegal cigarettes in California.

Of the total sample, 27.6 percent of the cigarette packs that were discarded in California were from foreign or illicit sources. These smuggled cigarettes came from sources such as duty-free products that were supposed to be exported but were illegally brought back into California. Another 4.0 percent of the sample were cigarettes that were illegally brought to California from other states or were counterfeit products. The state excise tax on cigarettes was not applied to any of these products.

The large growth in the counterfeit market indicates that, relative to actual cigarette use, the lost revenues to the state are even larger than the official revenue figures indicate. Applying the survey percentages to the 2023 cigarette excise tax collections, the state has potentially lost over $615 million in cigarette excise tax revenues. It is important to recognize that these lost revenues were not a result of fewer people smoking – they exist because people are consuming illegal and untaxed cigarettes.

Importantly, it was not possible to determine whether 27 percent of the surveyed packs were legitimate tax-paid cigarettes or smuggled cigarettes. The above estimates assume that all these unknown packs paid the appropriate California excise taxes. To the extent that some of these unknown packs were illegal products – a likely outcome – the potential state revenue losses are even larger.

Increased illegal sales is not just a government revenue problem either. The growth of illegal sales means that law abiding retailers lose revenues to the illegal markets. The diminished economic activity weakens the vitality of California retailers already struggling with the state’s costly regulations and high taxes.

California’s 2022 tobacco flavor ban is the latest example of a government prohibition gone wrong. Like most prohibitions that preceded it, the policy is imposing large harms on the state while failing to meaningfully change people’s behavior. While it is never wise to implement policies that impose net costs, the costs from the state ban are particularly ill-timed given California’s large budget crisis and weakening economy. Repealing the ban would alleviate these costs while improving state revenues and helping legitimate retailers during difficult economic times.

Dr. Wayne Winegarden is a senior fellow in business and economics at the Pacific Research Institute.

[1] WSPM Group “WSPM Group Empty Pack Survey USA-CA Q2 2023” Prepared for Altria, August 2023, https://www.altria.com/-/media/Project/Altria/Altria/about-altria/government-affairs/public-policy-positions/CA-EDP-Report.pdf.

[2] Hoffer A “Californians Still Smoking Menthol after Ban: Evidence from a Discarded Pack Audit” Tax Foundation, October 26, 2023, https://taxfoundation.org/blog/california-menthol-ban-cigarettes/#:~:text=The%20data%20show%20that%20Californians,form%20of%20menthol%20work%2Daround.