With the turning of the page on the calendar to May comes the anticipated arrival of Gov. Gavin Newsom’s “May Revise” budget plan, which should be released around May 10.

The May Revise is the governor’s updated budget plan taking into account the state’s latest economic forecasts and cash receipts. It is the basis from which final budget negotiations will begin with the Legislature, working toward the June 15 budget deadline.

In anticipation of the release of the governor’s plan, legislators have been trying to strengthen their position in the upcoming budget negotiations by setting forth their budget priorities. On Wednesday, Senate Democrats released their spending wish list to “protect our progress.” Of course, progress is in the eye of the beholder. Looking through their plan, it’s clear that progress for Senate Democrats is higher taxes and higher spending.

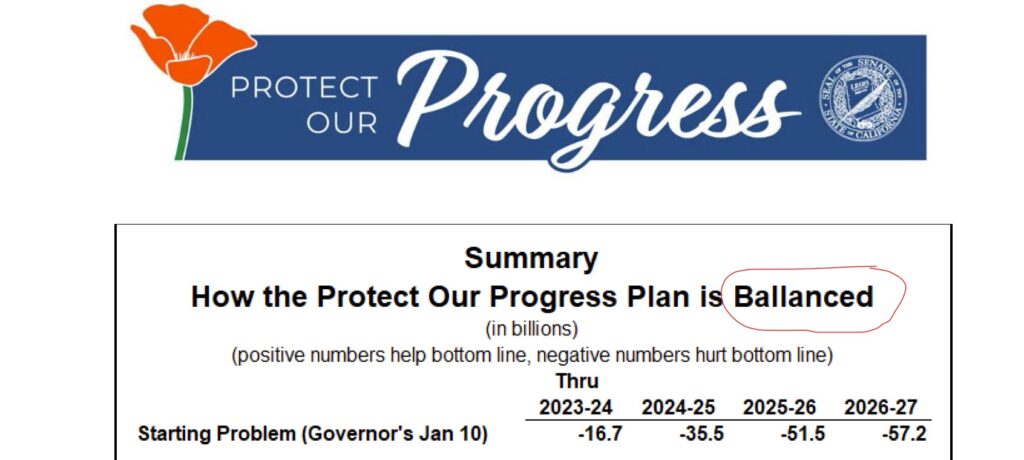

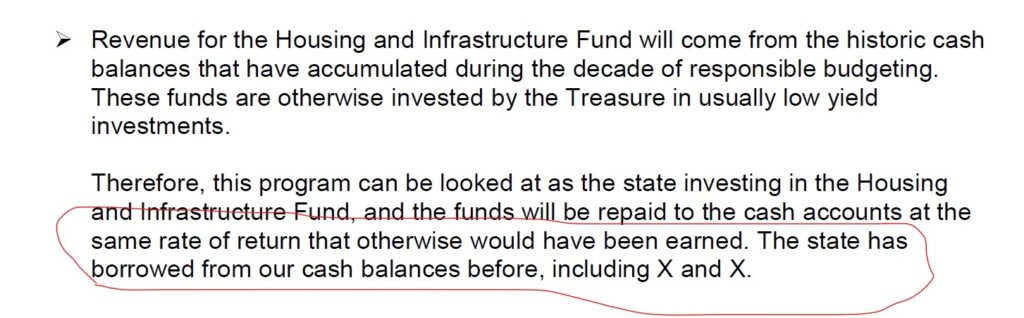

(As an aside, Senate Democrats need to hire a proofreader as I’ve never seen so many grammatical and spelling errors in a press document. A summary chart on Page 7 details “How the Protect Our Progress Plan is Ballanced” while on Page 14 it notes that “the state has borrowed from our cash balances before, including X and X.”)

The focus of the Senate Democrat plan, not surprisingly, is on taxes. They propose a new corporate tax bracket of 10.99 percent for taxable income over $1.5 million – all California businesses currently pay a flat corporate tax of 8.84 percent. The tax would be lowered to 6.63 percent for the first $1.5 million in taxable income. This would be a $7.2 billion tax hike in the 2023-24 fiscal year.

Dr. Wayne Winegarden, PRI senior fellow in business and economics, says that “the proposals do not seem to add up” and that the revenue estimates from the new tax “seem like a complete over-estimate.”

Winegarden, the co-author of PRI’s “California Migrating” study, says that “the tax increase will accelerate the departure of large corporations from California.”

“Why on earth would any company report California profits?” he said. “It should be easy enough to transfer profits out of state, so I can’t imagine the tax will raise the necessary revenues.”

The tax plan even goes too far for Gov. Gavin Newsom, whose spokesman said in a statement that, “it would be irresponsible to jeopardize the progress we’ve all made together.”

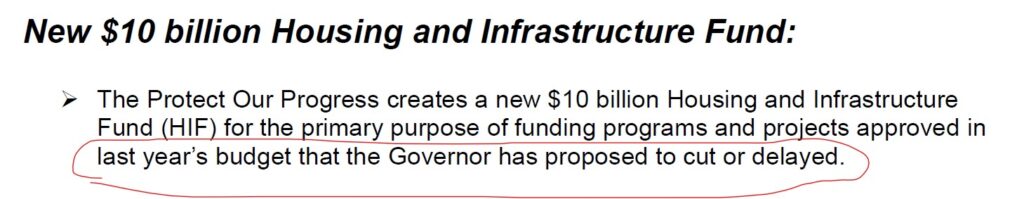

Democrats would use the new revenue to pay for a host of spending increases, and restorations of spending reductions or temporary suspensions proposed in Gov. Newsom’s January budget. The hallmark of the plan is the creation of “a new $10 billion Housing and Infrastructure Fund (HIF) for the primary purpose of funding programs and projects approved in last year’s budget that the governor has proposed to cut or delayed (sp).” This includes $1.7 billion for government affordable housing programs, $2.1 billion for clean energy projects and boosting spending for the high speed rail “train to nowhere” by more than $400 million over Newsom’s proposal.

The plan would also provide another $1 billion in ongoing funds for homeless housing programs – furthering expensive programs that PRI’s research has found to be ineffective in reducing homelessness – and would continue efforts to expand Medi-Cal eligibility for all undocumented living in California, which prior estimates have shown could cost over $3 billion annually once fully implemented.

It also relies upon $8 billion in spending delays and $10.1 billion in fund shifts to pay for their increased spending, in addition to the tax increases. Winegarden says that “the fund transfers are just shell games that are an attempt to hide the underlying truth that this budget is an old fashioned tax and spend budget.”

The bottom line, as Winegarden says, “tax and spend is a recipe for economic decline, which is what will happen here in California.”

All eyes are now on Gov. Newsom to see how he will respond with his May Revise budget plan.

Tim Anaya is the Pacific Research Institute’s vice president of marketing and communications.