The July 13th report on consumer price inflation (CPI-U) confirmed what we all already knew – prices have become unaffordable. Consumer price inflation rose 9.1 percent over the last year, which is the fastest inflation rate in 40+ years. The impetus for this current bout of inflation is not mysterious.

Over the past couple of years, the federal government spent trillions of dollars, ostensibly in response to the Covid-19 pandemic. These expenditures were on top of the government’s already bloated multi-trillion-dollar budget. Since the government did not have trillions of dollars laying around, it borrowed this money. Ultimately, the Federal Reserve purchased this new debt by creating an unprecedented amount of new money. It is this excessive amount of money creation that is driving up inflation.

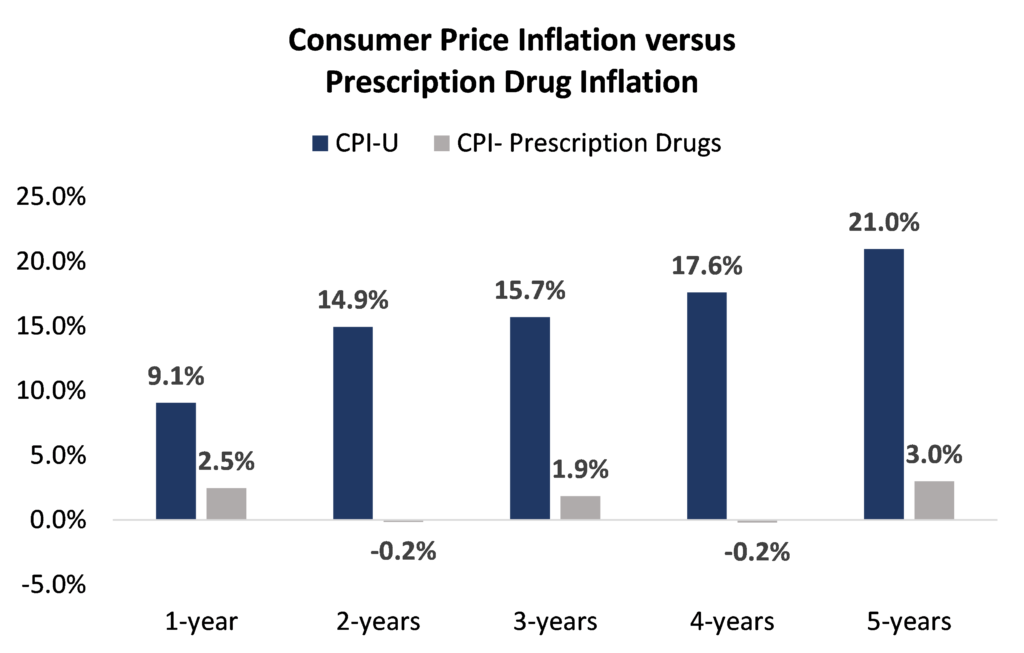

Despite this reality, the Biden Administration and Senator Schumer keep looking for corporate scapegoats, and one of their favorites is the prescription drug industry. They erroneously claim that increases in drug price are driving inflation, therefore drug price controls – a policy they want to implement regardless of the current inflationary trends – are necessary to control inflation. There is just one problem. Price inflation for prescription drugs in the latest CPI report was less than one-third the overall inflation rate – prescription drug inflation has grown 2.5 percent over the last year. In fact, the annual growth in prescription drug price inflation has been significantly lower than overall inflation rate over the past 5-years.

Source: Author calculations based on BLS CPI data

Source: Author calculations based on BLS CPI data

There are several important lessons from this data. First, inflation continues to erode consumers’ budgets harming families across the country. Helping families regain their financial security by bringing inflation under control should be policymakers’ top priority. This will require continued monetary tightening by the Federal Reserve and, though unlikely, should also include fiscal discipline by the federal government.

Second, the inflation problem has nothing to do with the prices of prescription drugs. When policymakers use inflation to justify prescription drug price controls, they are either ignorant to the actual price trends or are being dishonest to inflation’s actual causes. Either way, if these calls are heeded and price controls are implemented, then there will be a high cost to pay.

From a healthcare perspective, price controls will deprive patients of future treatments and cures to devastating diseases such as Alzheimer’s and multiple sclerosis (MS). From an economic perspective, price controls will dampen one of the economy’s most productive sectors. Economic growth will lessen and, by diminishing the economy’s potential growth rate, prescription drug price controls actually worsen long-run inflationary pressures.

Third, the fact that the prices for prescription drugs are not driving inflation does not mean that there are not affordability issues when it comes to certain medicines. There are. But these issues are due to supply chain deficiencies that need to be addressed with targeted market reforms. Confusing these problems with the factors driving inflation will only worsen both problems.

Coupling the uncertain economic outlook with the current inflationary trends raises the alarm that the U.S. economy is facing a threat we have not seen since the 1970s – stagflation, or the combination of a stagnant economy plagued with rising inflation. This unwelcome re-run is not pre-ordained but will likely come to pass if prescription drug price controls is Washington D.C.’s answer to our rising inflationary problem.

Dr. Wayne Winegarden is the director of the Center for Medical Economics and Innovation at the Pacific Research Institute and a PRI senior fellow in business and economics.