Tax Credits for a Tesla?

By Munr Kazmir and Brooke Bell

What Tesla did for electric automobiles was much more important than a tax-break incentive meant to encourage people to purchase electric cars.

Tesla made electric cars cool.

From the cool science-y name, to the futuristic streamlining of their luxury sports cars; from the vegan leather seats, to the swanky showrooms nestled in the world’s hottest cities. You can find a Tesla dealership in the very best retail boutique neighborhoods from New York to Tokyo, in high-end Galleries. Tesla has become a highly sought-after brand.

Celebrities drive them, pop-stars drive them, athletes drive them, trust-fund billionaires drive them. Cool people drive them.

Rich people drive them.

Driving a Tesla is the new status symbol. It is meant to convey a certain message, and it does: “I am a wealthy person who cares about the environment.”

Now passé are the tragic-cool gas-guzzling Hummers and Land Rovers of the past. A giant SUV, no matter the price tag, is no longer the badge of cultural honor it once was. In many circles, the once ubiquitous auto has become the opposite of a status symbol. It is, after all, a statistical fact that people who listen to NPR do not own Hummers and people who own Hummers do not listen to NPR.

And in full circle, the large tax write-offs small business owners once used to buy jumbo sport-utility vehicles are now being applied to electric Teslas. Albeit, for totally different reasons. But both ultimately for no good point.

No Good Deed Goes Unpunished

Because everything has consequences.

Call it the Law of Unintended Consequences. In February 2018, a Pacific Institute Research study found that 79% of electric vehicle tax credits were claimed by households making over $100,000 per year. Households making more than $50,000 per year claimed 99% percent of the credits.

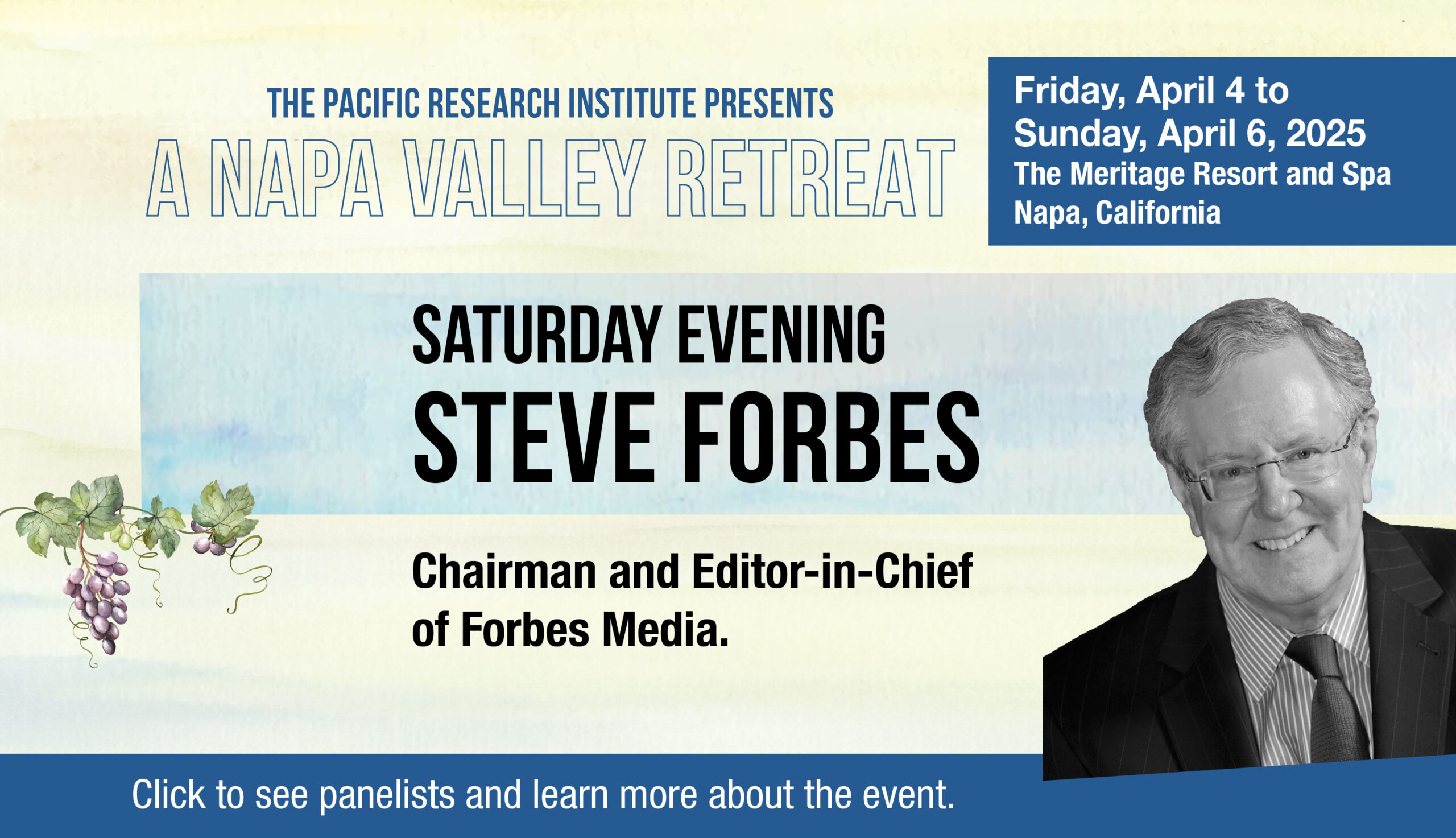

“When politicians talk about the need to subsidize costly electric cars, they fail to tell you that the hundreds of millions of dollars of subsidies that taxpayers are paying for are just another giveaway to the wealthy. After reading our new study, taxpayers should start asking elected officials what benefit we are getting from these expensive subsidies that only benefit upper-income households.” – Dr. Wayne Winegarden, Pacific Institute Research

The study also found that federal funding accounts for $40.7 billion over the lifetime of the programs and an additional $2 billion in federal tax credits to subsidize electric car purchases, up to $7,500 per car . . .